With a limited pool of labor and rising costs, Singapore seeks to develop disruptive manufacturing technologies in order to retain its competitive edge.

Automation, Internet of Things (IoT), additive manufacturing and all processes that assist Singapore in addressing rising costs and labor shortages are paramount to the successful development of the country’s aerospace industry. Despite the industry’s investments in new training facilities to grow the number of graduates in the market, such as Haite Group’s S$95 million (US$67 million) training facility with simulators, the speed at which skilled labor is needed in the region is greater than the country’s capacity to supply trained workers at the moment. The EDB and A*STAR are investing heavily on technology innovation processes. “We are currently looking at the application of robotics, automation, data analytics and additive manufacturing. In the nearer term, we are focused on innovations and technology that would make Singapore more competitive,” said Tan Kong Hwee, director, transport engineering, EDB.

Though Industry 4.0 processes will aid the industry at the moment, whether this can feasibly act as a permanent solution remains uncertain. The first concern that must be addressed is the speed at which the transition into automation can take place within the industry. “In my opinion, it will take an incredible amount of alignment with the manufacturers and regulators to implement robotics and automation successfully into aerospace operations,” said John Riggir, vice president and general manager, JET Aviation.

Though the company has implemented 3D scanning to reproduce aircraft interiors and utilizes cutting-edge 3D engineering and manufacturing processes to cut honeycomb panels with laser and water jets, the real advantages will be felt in terms of aircraft assembly, where skilled labor will be replaced by automation. The company is not focused on Artificial Intelligence (AI) at the moment, but believes that no regulator will be allocating permits and approvals within that realm anytime soon.

Although the EDB is pushing for robotics and AI developments within the aerospace field,

some are questioning the capacity that disruptive technologies will have to truly aid their operations, especially given the high-levels of investment required to implement them. “Using automation in the aerospace aftermarket environment would require a major investment whereby I reckon not many SMEs would find it economically viable […] The challenge is not how to get it automated, but rather, what is the payback?” said Philip Sung, director, sales and operations, Esterline.

Nonetheless, the opportunities to be found within the repair value stream are to be explored. In order for automation to become more common, it has to prove that it can provide greater advantages and solutions for Singapore than the sourcing of skilled-labor within the SEA region.

The reasoning behind companies’ decisions to seek out disruptive technologies is quite varied. In the case of Accuron, it is the drive to take precision engineering up the value chain with own designs, which require more cost-efficiencies. “We will always watch out for disruptive technologies and techniques, such as additive manufacturing. It may take a while for this to truly become prevalent in the aerospace industry, but I think that change will take place swiftly. We will also see people making use of Industry 4.0, IoT, or simply automation to improve the manufacturing process,” said Tan Kai Hoe, president and chief executive officer, Accuron.

Wah Son Engineering has decided to introduce robotic welding in their flexible manufacturing cell within a year’s time. “Despite the current market sentiments and inherent risk of failure, we are compelled to think long-term instead of making decisions based solely on an immediate-term cost-benefit analysis. We see this as the way forward because of the shortage of skilled Singaporean welders and machinists will be a perennial issue,” said Lim Hee Joo, executive director, Wah Son Engineering.

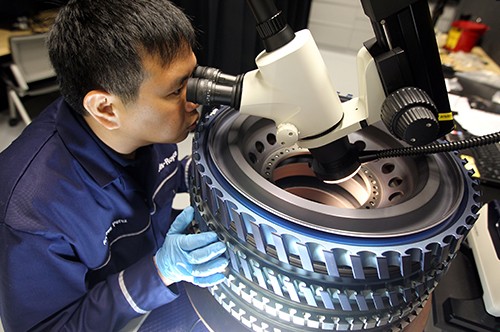

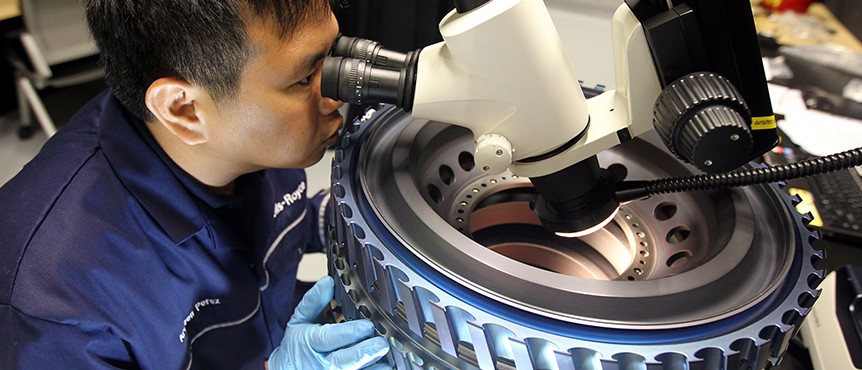

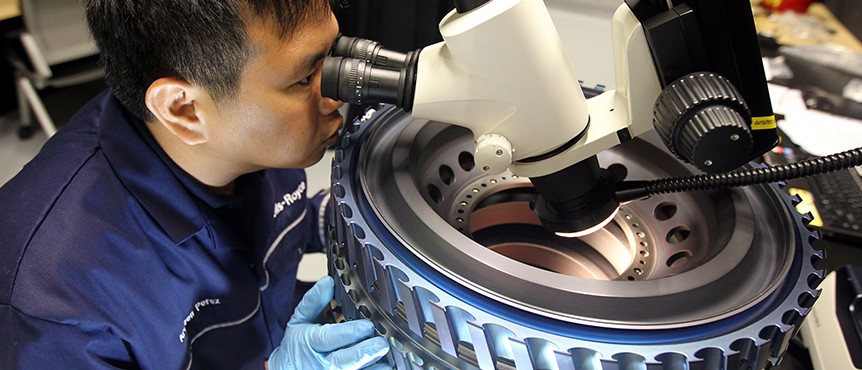

Rolls-Royce has also implemented a full range of processes within the digital sector, from software and connectivity, to sensor technologies. The UK-based industry giant has already implemented the use of Big Data within its civil aerospace TotalCare service offering. “We are pioneering the technology behind autonomous vessels, utilizing IoT, which can be remotely controlled,” said Bicky Bhangu, director Singapore, Rolls-Royce.

Despite the challenges in pioneering new technologies, Rolls- Royce is a firm believer that implementing Industry 4.0 processes will add value to their operations in the future. “One of the major challenges in the digital field is creating adequate algorithms that can integrate the whole value chain,” added Bicky Bhangu.

The company has positioned itself as a systems integrator that is able to partner with clients to provide them with predictive maintenance. New simulators and AI are being developed in Singapore for the aerospace industry primarily for the military and defense industries, which need to focus on crisis management within airports. Asia Technical Service’s partners, MASA, are developing an AI system alongside the French army, to train high-level military officials. “This constructive simulation software, with its AI, is being used within the Singapore Ministry of Defense’s think tank,” said Patrick Garez, managing director, Asia Technical Services.

Although these new Serious Game type technologies are still foreign to the market, they are gradually becoming more common. “I believe they will take hold of the industry and evolve incredibly rapidly,” he added.

The company is creating a strategy for a 70% staff reduction within the army based on these simulation technologies.

Though most 3D and VR technologies tend to remain within the commercial segment of OEMs, the training possibilities are being explored. MROs will require a longer process of certification and approvals in order to be able to implement such interactive training materials within their operations. The implementation of mobility, digitization and big data represent a change in the way that companies relate to customers, employees and their own processes. Various companies, such as Lufthansa Systems, are positioned to assist clients by implementing IT solutions to optimize their service offering through data analytics.

Accessing and analyzing the large amounts of data that are collected by airlines can help them improve and even personalize their services for passengers. IoT sensors can be used to collect data regarding temperature, engine performance and even passenger in-flight entertainment choices. According to Lufthansa Systems: “In the airline-passenger relationship, process digitization and data usage are the key to differentiating oneself from the competition, by offering personalized products and services.”

Despite Singapore’s clear footprint within the realm of future technologies, the rapid growth experienced in the surrounding emerging markets is also placing pressure on the country to continue innovating and improving. “As countries in the region develop and modernize, the gap that currently makes Singapore stand out from the rest will certainly narrow. This means that continuous innovation is indispensable,” said Christophe Potocki, general manager, sales, ATR.

The continuous pursuit to spearhead the development of smart technologies and Big Data processes remains at the heart of many Singapore operations.

UAVs remain an area of interest for the Singapore aerospace industry, and the EDB aims to explore all the ways in which research institutions can partner with companies working in the eld. The “Civil Aviation Authority of Singapore (CAAS) has signed an MoU with Airbus to experiment with delivery drones,” said Tan Kong Hwee.

The EDB, A*STAR and the CAAS, along with Universities such as NTU, are undertaking the incredibly challenging feat of experimenting with UAVs to determine the extent to which these new technologies can aid the increasingly demanding market in the country. With the level of investment and know-how in the country, Singapore is well positioned to lead the way and determine the ways in which the world can implement new technologies to assist the operations of the aerospace industry.

Automation, Internet of Things (IoT), additive manufacturing and all processes that assist Singapore in addressing rising costs and labor shortages are paramount to the successful development of the country’s aerospace industry. Despite the industry’s investments in new training facilities to grow the number of graduates in the market, such as Haite Group’s S$95 million (US$67 million) training facility with simulators, the speed at which skilled labor is needed in the region is greater than the country’s capacity to supply trained workers at the moment. The EDB and A*STAR are investing heavily on technology innovation processes. “We are currently looking at the application of robotics, automation, data analytics and additive manufacturing. In the nearer term, we are focused on innovations and technology that would make Singapore more competitive,” said Tan Kong Hwee, director, transport engineering, EDB.

Though Industry 4.0 processes will aid the industry at the moment, whether this can feasibly act as a permanent solution remains uncertain. The first concern that must be addressed is the speed at which the transition into automation can take place within the industry. “In my opinion, it will take an incredible amount of alignment with the manufacturers and regulators to implement robotics and automation successfully into aerospace operations,” said John Riggir, vice president and general manager, JET Aviation.

Though the company has implemented 3D scanning to reproduce aircraft interiors and utilizes cutting-edge 3D engineering and manufacturing processes to cut honeycomb panels with laser and water jets, the real advantages will be felt in terms of aircraft assembly, where skilled labor will be replaced by automation. The company is not focused on Artificial Intelligence (AI) at the moment, but believes that no regulator will be allocating permits and approvals within that realm anytime soon.

Although the EDB is pushing for robotics and AI developments within the aerospace field,

some are questioning the capacity that disruptive technologies will have to truly aid their operations, especially given the high-levels of investment required to implement them. “Using automation in the aerospace aftermarket environment would require a major investment whereby I reckon not many SMEs would find it economically viable […] The challenge is not how to get it automated, but rather, what is the payback?” said Philip Sung, director, sales and operations, Esterline.

Nonetheless, the opportunities to be found within the repair value stream are to be explored. In order for automation to become more common, it has to prove that it can provide greater advantages and solutions for Singapore than the sourcing of skilled-labor within the SEA region.

The reasoning behind companies’ decisions to seek out disruptive technologies is quite varied. In the case of Accuron, it is the drive to take precision engineering up the value chain with own designs, which require more cost-efficiencies. “We will always watch out for disruptive technologies and techniques, such as additive manufacturing. It may take a while for this to truly become prevalent in the aerospace industry, but I think that change will take place swiftly. We will also see people making use of Industry 4.0, IoT, or simply automation to improve the manufacturing process,” said Tan Kai Hoe, president and chief executive officer, Accuron.

Wah Son Engineering has decided to introduce robotic welding in their flexible manufacturing cell within a year’s time. “Despite the current market sentiments and inherent risk of failure, we are compelled to think long-term instead of making decisions based solely on an immediate-term cost-benefit analysis. We see this as the way forward because of the shortage of skilled Singaporean welders and machinists will be a perennial issue,” said Lim Hee Joo, executive director, Wah Son Engineering.

Rolls-Royce has also implemented a full range of processes within the digital sector, from software and connectivity, to sensor technologies. The UK-based industry giant has already implemented the use of Big Data within its civil aerospace TotalCare service offering. “We are pioneering the technology behind autonomous vessels, utilizing IoT, which can be remotely controlled,” said Bicky Bhangu, director Singapore, Rolls-Royce.

Despite the challenges in pioneering new technologies, Rolls- Royce is a firm believer that implementing Industry 4.0 processes will add value to their operations in the future. “One of the major challenges in the digital field is creating adequate algorithms that can integrate the whole value chain,” added Bicky Bhangu.

The company has positioned itself as a systems integrator that is able to partner with clients to provide them with predictive maintenance. New simulators and AI are being developed in Singapore for the aerospace industry primarily for the military and defense industries, which need to focus on crisis management within airports. Asia Technical Service’s partners, MASA, are developing an AI system alongside the French army, to train high-level military officials. “This constructive simulation software, with its AI, is being used within the Singapore Ministry of Defense’s think tank,” said Patrick Garez, managing director, Asia Technical Services.

Although these new Serious Game type technologies are still foreign to the market, they are gradually becoming more common. “I believe they will take hold of the industry and evolve incredibly rapidly,” he added.

The company is creating a strategy for a 70% staff reduction within the army based on these simulation technologies.

Though most 3D and VR technologies tend to remain within the commercial segment of OEMs, the training possibilities are being explored. MROs will require a longer process of certification and approvals in order to be able to implement such interactive training materials within their operations. The implementation of mobility, digitization and big data represent a change in the way that companies relate to customers, employees and their own processes. Various companies, such as Lufthansa Systems, are positioned to assist clients by implementing IT solutions to optimize their service offering through data analytics.

Accessing and analyzing the large amounts of data that are collected by airlines can help them improve and even personalize their services for passengers. IoT sensors can be used to collect data regarding temperature, engine performance and even passenger in-flight entertainment choices. According to Lufthansa Systems: “In the airline-passenger relationship, process digitization and data usage are the key to differentiating oneself from the competition, by offering personalized products and services.”

Despite Singapore’s clear footprint within the realm of future technologies, the rapid growth experienced in the surrounding emerging markets is also placing pressure on the country to continue innovating and improving. “As countries in the region develop and modernize, the gap that currently makes Singapore stand out from the rest will certainly narrow. This means that continuous innovation is indispensable,” said Christophe Potocki, general manager, sales, ATR.

The continuous pursuit to spearhead the development of smart technologies and Big Data processes remains at the heart of many Singapore operations.

UAVs remain an area of interest for the Singapore aerospace industry, and the EDB aims to explore all the ways in which research institutions can partner with companies working in the eld. The “Civil Aviation Authority of Singapore (CAAS) has signed an MoU with Airbus to experiment with delivery drones,” said Tan Kong Hwee.

The EDB, A*STAR and the CAAS, along with Universities such as NTU, are undertaking the incredibly challenging feat of experimenting with UAVs to determine the extent to which these new technologies can aid the increasingly demanding market in the country. With the level of investment and know-how in the country, Singapore is well positioned to lead the way and determine the ways in which the world can implement new technologies to assist the operations of the aerospace industry.