Singapore is determined to develop its niche in satellite and telecommunication technology.

As intelligent satellite based services expand, companies are realizing the importance of utilizing analytics to process Big Data for improved performances, as well as implementing IoT, and IDRS technologies. Remote sensing has become indispensable for disaster management, precision farming, climate change monitoring, urban planning and mineral exploration, as has satellite-based communication for the maritime and aerospace industries. Many R&D institutions are present in Singapore for companies to explore the multitude of possibilities for which satellite-based services and telecommunications can improve their operations. Singapore’s Centre for Remote Imaging, Sensing and Processing (CRISP) has the capacity to complete SAR, multi and hyper-spectral data analysis. The Institute for Infocomm Research (I2R) and the Institute of High Performance Computing (IHPC) are others exploring the many possibilities for sat-coms.

Singapore is not lacking in telecommunications opportunities. Communications equipment manufacturers, such as Addvalue Technologies, are providing services to lead service providers that rely on satellite technologies. Multiple satellite operators and communication service providers, such as SingTel, Thuraya and Intelsat have opted to base out of Singapore, leveraging on the country’s well-established infocomms and aerospace industry.

“We have reached a point where everybody is using navigational satellite technology, whether explicitly or not,” said Christine Koh, market development director, Spacetime Technology. Sensors and Global Navigation Satellite System (GNSS) chip-sets and receivers are used for air navigation, cellphone GPS applications, photo geocoding and even social networking. The broad usage of these technologies also poses some risks for the security and defense realm, where important country targets or networks could be disclosed unwillingly. Companies and service providers are trying to find the necessary balance between advancing technology and protecting their clients. “The main consumers for these GNSS technologies are governments and large corporations that need Big Data for their decision making processes. Smaller SMEs are still not implementing these, but we will see that the trend will change rapidly in years to come,” added Christine Koh.

Launched in October 2015 with the support of the EDB and GLAC (GNSS and LBS Association of China), Spacetime Technology’s Singapore Centre of Excellence (CoE) was created as the first advanced incubator for GNSS and LBS in Asia. Its goal is to develop new technologies and innovate processes in order to generate new solutions for the industry. “With a strong focus on making operations easier for businesses and having an impact on people’s daily lives, Spacetime Technology has the aim to launch technologies that can revolution the market,” said Ping Teck Huat.

IoT was implemented for M2M (Machine to Machine) applications nearly eight years ago for the oil and gas sector and technology has evolved significantly since then. “Addvalue is active in the IoT arena as the ubiquity and reliability of satellite communications are essential to complement the terrestrial communications to fulfill the insatiable desires of connectivity in any industry,” said Tan Khai Pang, chief technology and operating officer, Addvalue Technologies.

Earth observation and remote-sensing applications are now amply used by leading global players. High-resolution optical services have become a strong offering within the Singapore market. Singapore’s first commercial earth observation satellite, ST Electronics’s domestically built TeLEOS-1, was launched from India on December 16th, 2015. Five more home grown satellites were launched alongside it. The TeLEOS-1 is near an equatorial orbit and allows for higher re-visit rates as well as providing services for research institutions and security companies. “Many new and impactful applications could be demonstrated in/from Singapore for both military and civilian needs, for instance in the fields of earth observation, meteo-oceanography, navigation, data collect, telecommunications etc., leveraging on Thales excellence in optical and microwave satellite payloads, platforms and systems,” said Dr. Erick Lansard, vice-president for technical and space development, Thales.

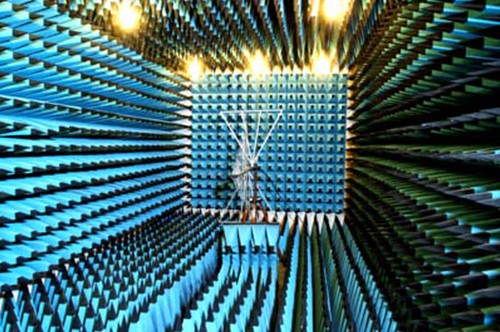

The Centre for Remote Imaging, Sensing and Processing (CRISP), based out of NUS, has been processing satellite images for the last 20 years as a non-profit ground station. Their imagery can be used across the value chain, but when paired with data-analysis, these technologies can even help aircraft save on fuel costs and strategize their routes better. The center is researching Synthetic Aperture Radar (SAR), as well as multi- and hyper- spectral data analysis. High throughput satellites (HTS), a type of communication satellites that provide over twice the total throughput of a traditional FSS satellite, are being used to explore new opportunities and applications within the aerospace industry.

Addvalue has also been exploring Inter-Satellite Data Relay Systems (IDRS), which are a means to addressing the ‘on-demand’ obstacle that LEO satellites were unable to overcome on their own Addvalue launched an IDRS terminal aboard the VELOX II, supplying a two-way IP based data service for LEO satellite operations, connecting them to higher-orbit GEO satellites, allowing for 24/7 on-demand results. The Addvalue IDRS services aim to be commercialized no later than the year 2020.

Beyond space exploration, Singapore has been involved in the development of an European Spaceplane through EADS Astrium, to make commercial sub-orbital flights possible. The aircraft is being developed by Airbus and aims to carry 4 passengers up to 100 Km above sea-level. OSTIn remains keen on attracting companies around the globe that intend to innovate and develop new technologies to position Singapore as an advanced-technology hub in the region and the world.

As intelligent satellite based services expand, companies are realizing the importance of utilizing analytics to process Big Data for improved performances, as well as implementing IoT, and IDRS technologies. Remote sensing has become indispensable for disaster management, precision farming, climate change monitoring, urban planning and mineral exploration, as has satellite-based communication for the maritime and aerospace industries. Many R&D institutions are present in Singapore for companies to explore the multitude of possibilities for which satellite-based services and telecommunications can improve their operations. Singapore’s Centre for Remote Imaging, Sensing and Processing (CRISP) has the capacity to complete SAR, multi and hyper-spectral data analysis. The Institute for Infocomm Research (I2R) and the Institute of High Performance Computing (IHPC) are others exploring the many possibilities for sat-coms.

Singapore is not lacking in telecommunications opportunities. Communications equipment manufacturers, such as Addvalue Technologies, are providing services to lead service providers that rely on satellite technologies. Multiple satellite operators and communication service providers, such as SingTel, Thuraya and Intelsat have opted to base out of Singapore, leveraging on the country’s well-established infocomms and aerospace industry.

“We have reached a point where everybody is using navigational satellite technology, whether explicitly or not,” said Christine Koh, market development director, Spacetime Technology. Sensors and Global Navigation Satellite System (GNSS) chip-sets and receivers are used for air navigation, cellphone GPS applications, photo geocoding and even social networking. The broad usage of these technologies also poses some risks for the security and defense realm, where important country targets or networks could be disclosed unwillingly. Companies and service providers are trying to find the necessary balance between advancing technology and protecting their clients. “The main consumers for these GNSS technologies are governments and large corporations that need Big Data for their decision making processes. Smaller SMEs are still not implementing these, but we will see that the trend will change rapidly in years to come,” added Christine Koh.

Launched in October 2015 with the support of the EDB and GLAC (GNSS and LBS Association of China), Spacetime Technology’s Singapore Centre of Excellence (CoE) was created as the first advanced incubator for GNSS and LBS in Asia. Its goal is to develop new technologies and innovate processes in order to generate new solutions for the industry. “With a strong focus on making operations easier for businesses and having an impact on people’s daily lives, Spacetime Technology has the aim to launch technologies that can revolution the market,” said Ping Teck Huat.

IoT was implemented for M2M (Machine to Machine) applications nearly eight years ago for the oil and gas sector and technology has evolved significantly since then. “Addvalue is active in the IoT arena as the ubiquity and reliability of satellite communications are essential to complement the terrestrial communications to fulfill the insatiable desires of connectivity in any industry,” said Tan Khai Pang, chief technology and operating officer, Addvalue Technologies.

Earth observation and remote-sensing applications are now amply used by leading global players. High-resolution optical services have become a strong offering within the Singapore market. Singapore’s first commercial earth observation satellite, ST Electronics’s domestically built TeLEOS-1, was launched from India on December 16th, 2015. Five more home grown satellites were launched alongside it. The TeLEOS-1 is near an equatorial orbit and allows for higher re-visit rates as well as providing services for research institutions and security companies. “Many new and impactful applications could be demonstrated in/from Singapore for both military and civilian needs, for instance in the fields of earth observation, meteo-oceanography, navigation, data collect, telecommunications etc., leveraging on Thales excellence in optical and microwave satellite payloads, platforms and systems,” said Dr. Erick Lansard, vice-president for technical and space development, Thales.

The Centre for Remote Imaging, Sensing and Processing (CRISP), based out of NUS, has been processing satellite images for the last 20 years as a non-profit ground station. Their imagery can be used across the value chain, but when paired with data-analysis, these technologies can even help aircraft save on fuel costs and strategize their routes better. The center is researching Synthetic Aperture Radar (SAR), as well as multi- and hyper- spectral data analysis. High throughput satellites (HTS), a type of communication satellites that provide over twice the total throughput of a traditional FSS satellite, are being used to explore new opportunities and applications within the aerospace industry.

Addvalue has also been exploring Inter-Satellite Data Relay Systems (IDRS), which are a means to addressing the ‘on-demand’ obstacle that LEO satellites were unable to overcome on their own Addvalue launched an IDRS terminal aboard the VELOX II, supplying a two-way IP based data service for LEO satellite operations, connecting them to higher-orbit GEO satellites, allowing for 24/7 on-demand results. The Addvalue IDRS services aim to be commercialized no later than the year 2020.

Beyond space exploration, Singapore has been involved in the development of an European Spaceplane through EADS Astrium, to make commercial sub-orbital flights possible. The aircraft is being developed by Airbus and aims to carry 4 passengers up to 100 Km above sea-level. OSTIn remains keen on attracting companies around the globe that intend to innovate and develop new technologies to position Singapore as an advanced-technology hub in the region and the world.