Investors advocate for the lesser “evil”

Image by Anoop VS at Pexels

Humans seem to be programmed to prioritize the present over the future, at least when it comes to dealing with crises. Between struggling with access to energy today and imagining the adverse impacts of climate change in the all-so-vague tomorrow, most would say ‘Let’s tackle one thing at a time.’ Twenty years from now, our older selves and new generations will likely be blaming us for not doing more to combat global warming, but in 2024, the energy crisis was a hard-to-digest reminder that the world is still hooked on fossil fuels. The oil and gas industry climbed out of an era of downturn, emerging stronger than ever.

Surprisingly or not, the world’s supposedly dying industry is currently the most profitable one. The oil and gas (O&G) exploration and production (EP) sector cashed in US$5.3 trillion between 2018-2023, more than any other sector. The global energy crisis that started in 2022 bumped up revenues to a 10-year high that year, a record that was broken again in 2023. Emissions grew too, reaching 12.1 billion tpa in 2023 – about a third of all industrial emissions – according to the Global Carbon Project.

The geopolitical train of events culminating in worries around energy security saw investors paddling back on climate worries and forward on petro-gas dollars. Within this global re-awakening to oil and gas, investment in Southeast Asia’s O&G development is booming, from US$9.5 billion in 2022-2023 to US$30 billion in the 2024-2025 period, informs intelligence company Rystad Energy. That would set the industry growing by 4% for the next five years, according to Energy Council. Another source, EcoBusiness News, estimated that China and Southeast Asia are leading global O&G developments in Asia, the continent accounting for two-thirds of the world’s total.

High GDP growth, industrialization and a slower electrification pace compared to the rest of the world explain why the region emerges as a very large and growing energy user. In a “stated policy scenario,” IEA anticipates total consumption in Southeast Asia will rise by 80% by 2050. That trend contrasts with the rest of the world: “Energy demand in Southeast Asia is set to nearly double over the coming few decades, while in the rest of the world energy demand is getting close to the peak and will flatten, as GDP growth and energy demand start decoupling due to greater energy efficiencies. Unlike other regions, Southeast Asian countries will not only have to decarbonize existing energy supply but also find a way to meet this huge growth in energy demand,” explained James Laybourn, APAC regional sales director for DNV Energy Systems, an energy advisory.

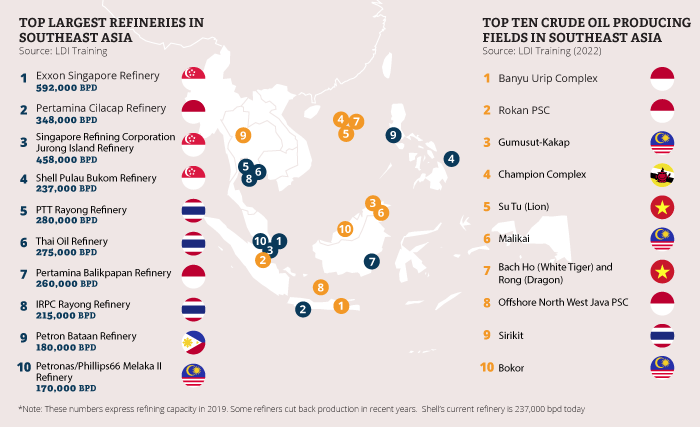

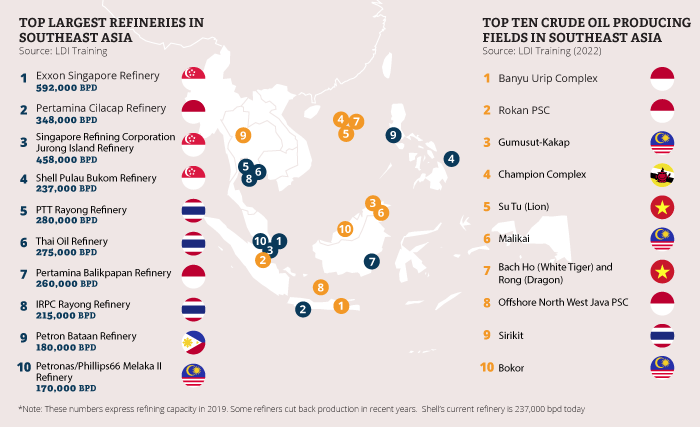

What also attracts investment to Southeast Asia is the region’s legacy and maturity in oil and gas. Outputs in the largest producing countries for oil (Indonesia, Malaysia, and Vietnam) and gas (Indonesia, Malaysia, and Thailand) had been declining, mostly on account of a low-price environment in fields that are generally offshore and more costly to develop and operate. Climate pressures also put off investors. Across the region, 4.861 million boed of crude, condensate, and natural gas were produced in 2023, according to GlobalData. That number is expected to spike, with CapEx doubling by 2027. Over the last five years, 7 billion barrels of oil were discovered in the region, 2 billion of which just last year, writes Upstream Online.

A flurry of major discoveries lit up investors’ interest in Southeast Asia, driving exploration and development work. One of them is Mubadala Energy’s Layaran and Tangkulo gas discovery at the South Andaman Block, which stoked enthusiasm for the broader acreage on the island of Sumatra, Indonesia. Italian energy group Eni also announced last year a big gas discovery from a well in North Ganal PSC, off the coast of East Kalimantan, Indonesia, with preliminary estimates of 5 trillion cubic feet (tcf) of gas and estimated condensate of up to 400 million barrels. In Malaysia, the country’s national energy company, Petronas, is preparing to bring Kasawari to production this year, a gas field discovered in 2011, while Shell’s Rosmari-Marjoram has also reached a final investment decision in 2022, eight years after being discovered. These last two make the largest gas fields in the country.

The offshore Serawak basin, where both of these projects are located, is a focal exploration area, with more projects in the pipeline: Petronas Carigali, the upstream company of state-owned Petronas, is to appraise its 2023 Singsing discovery in the Western Luconia, while PTTEP, the upstream business of Thai national energy company PTT, is looking to drill an appraisal well on the Chenda oil and gas discovery offshore Sarawak, made in 2023, as part of a cluster development with two other discoveries. Shell is also active, with extensive exploration and development drilling on the MLNG block, offshore Sarawak.

The region’s O&G sector is led by state-owned, upstream-to-downstream integrated companies: Petronas in Malaysia; PTT in Thailand; Pertamina in Indonesia; PetroVietnam; and PNOC in the Philippines. They work across borders and often together, despite being competitors in the petrochemical space. For instance, PTT is heavily invested in Malaysia, while Malaysia’s Petronas is active in Indonesia. Some companies are operating in shared waters, like Malaysian-listed Hibiscus Petroleum, which recently made a second discovery on oil Block PM3 CAA in the Malaysia-Vietnam commercial agreement area. But the big dollars are sought out from large foreign investors.

Petronas has recently awarded production-sharing agreements for six exploration blocks in the 2023 bidding round, as well as launching a new round for another 10 blocks this year. Malaysia has recently signed multiple MoUs with China’s Sinopec to explore crude oil, LNG, and petrochemical opportunities in the region, and has engaged Japanese companies on CCS. French major TotalEnergies has recently bought the full shares of SapuraOMV, a gas producer with a 40% stake in Block SK408 and a 30% stake in Block SK310, both in offshore Sarawak, Malaysia. American supermajor Chevron has acquired Hess, with assets in Malaysia. According to Petronas public documents, Malaysia’s goal of maintaining 2 million barrels of oil equivalent per day by 2025 will be supported through a pipeline of projects including Kasawari, Jerun, Rosmari-Marjoram and Lang Lebah in Sarawak, Gumusut-Kakap Redev and Belud Clusters in Sabah, and Bekok Oil Redev, Tabu Redev and Seligi Redev in Peninsular Malaysia. 25 wells are forecast to be drilled every year in the shallow waters of Malaysia and 45 upstream projects to be executed, together with four Central Processing Platforms (CPPs), three onshore facilities, and 1,130 km of pipelines to be fabricated.

On its side, Indonesia will auction 10 blocks this year in the North Sumatra basin, where Mubadala has recently made its discovery. One of the companies taking up acreage from Indonesia’s 2023 bidding round was Petronas, awarded with the Bobora production sharing contract offshore in Papua Barat province in the east of the country. Indonesia is leveraging recent discoveries as well as reformed fiscal policies to attract new investment in the North Sumatra basin. Last year, Indonesia drilled only 20 wells, but plans to double that number this year, writes Energy Council. Over the past decade, exploration plunged by about 23%, and the number of wells also fell from 64 in 2014 to 30 in 2022. Pertamina has teamed up with Italian energy company Eni in a new MoU to explore the potential of several blocks and signed another MoU with UK company Conrad to look together at the potential commercialization of two offshore licenses that Conrad has in the Aceh region. Eni has acquired Neptune’s entire portfolio minus Norway, including Eni-operated Geng North-1 gas discovery, offshore Indonesia. Indonesia has a goal to lift 1 million bpd and 12 billion cf/d of gas by 2030.

With the rises in oil prices, projects became more economic, but the other catalyst to new development is carbon economics, especially for gas fields. Typically, gas fields with high CO2 content have a lower chance of being brought to production. A solution was found in carbon capture and storage (CCS), which changes project credentials. For instance, Petronas’ Kasawari can be said to not only produce 900 million standard cubic feet per day of gas and 3.5 million barrels of condensate per day but also to capture up to 3.3 million tons of carbon dioxide. Petronas Carigali and JX Nippon Oil and Gas have also committed to an integrated offshore gas plus carbon capture and storage solution in the BIGST project, Malaysia’s next largest gas development after Kasawari, covering 4 trillion cubic feet of gas with a high CO2 content, the reason why it was never developed. A project’s flaw turns into an opportunity to store its own emissions, and, with potential scale-ups, emissions not of its making.

Because it burns more cleanly compared to oil and coal, gas is considered the lesser evil in the fossil fuel club. CCS is meant to make it even cleaner. By making use of saline aquifers and depleted oil and gas reservoirs for storage, CCS also provides a “reuse” opportunity in the context of circularity, which gives it extra credit. In Indonesia, the Ministry of energy and Natural Resources reported the country has a storage potential of 572 gigatons of CO2 in saline aquifers and an additional 4.85 gigatons of CO2 in depleted oil and gas reservoirs for CCS initiatives, as reported by S&P Global.

However, the compression of CO2 into a liquid pumped underground resembles an awful lot to brushing the trash under the carpet, some skeptics will say, which makes the technology controversial. It is feared that CCS will be treated as a quick fix that gives a free pass on more fossil fuel reliance and exploitation. That said, deploying CCS in a package with gas projects could be a starting point for self-standing CCS. James Laybourn, regional sales director for APAC at DNV Energy, explained: “The costs of the capture and sequestration are covered by the project. Whilst not directly contributing to global decarbonization efforts, an advantage of such projects is that they are already economically viable and once developed, they can potentially be used to support storage for other sources of CO2.”

Whereas Vietnam and Indonesia are focusing more on renewables, Malaysia is becoming one of the frontier appliers of CCS technology. Petronas is up to spending US$450 million on CCUS projects between 2023 and 2026, according to Rystad Energy. Regulators are also moving in that direction, requesting new developments to come with a carbon abatement strategy in place. “In many cases, investment approvals are contingent on CCS facilities built in parallel or as the next phase of a project. Gas projects are prioritized over oil, and those gas projects with a lower sulfur content are prioritized over those with a higher one. Yes, we see higher spending in the industry, which I believe is here to stay for the next five or so years, but with it, we also see a focus on leveraging low-carbon technologies for sustainable project delivery,” said Mahesh Swaminathan, Mahesh Swaminathan, EXCOM member and Senior VP Subsea and Floating Facilities, McDermott, a global EPC with regional headquarters in Kuala Lumpur, Malaysia.

Engineering, construction and procurement (EPC) as well as oilfield service (OFS) companies are very busy these days in Southeast Asia, not only on the traditional projects in the lifecycle of the oil and gas space – exploration, development, production, and decommissioning – but also on CCS, renewables, battery storage, hydrogen, and other low-carbon or carbon-abatement technologies. Service providers are bullish on both old and new types of projects. McDermott anticipates that up to 80% of demand will come from Australasia over the next 3-5 years. ABL sees a high increase in green-type projects, along with the usual ones: “2030 is only six years away, leaving a short timeframe to invest and execute projects that will allow Malaysia to meet its carbon commitments. Projects in carbon capture, floating solar, green hydrogen, and battery energy storage systems (BESS) are expected to grow in number and generate demand,” said Mohd Saifuddin Md Salleh, country manager for ABL Malaysia.

The service provider industry is putting its feet in both camps: the traditional development of oil and gas projects and related facilities, as well as new areas like hydrogen, CCS, or decommissioning and repurposing work on abandoned assets. In Malaysia alone, there are 130 wells and 50 facilities that need to be plugged out, according to Petronas. To serve both categories, the sector has seen some major re-restructuring. A good example is TechnipFMC, which spun off Technip Energies, the first dealing more with traditional LNG and ethylene business, and the latter taking up green hydrogen, plastic pyrolysis, sustainable chemistries, biofuels, waste, and carbon management, with flagship projects such as the Neste refinery in Singapore, among others. McDermott reorganized two years ago from a regional to a vertical-by-vertical structure, across multiple business lines; with that, Malaysia turned into a major global hub serving Australasia, West Africa, and the Americas. Global management consultancy firm Bain & Company has brought together its oil and gas, chemicals, mining, utilities, and agriculture under one practice called Energy and Natural Resources, one of the firm’s top three globally.

This diversification in the service sector is a reflection of what their customers, the oil and gas companies, have done. Some of the largest oil and gas companies are also the largest investors in renewables. They are advocates of both traditional and new energies. As a result of this cross-pollination, it is harder to distinguish the different businesses, once more siloed.

The discovery of oil and gas (O&G) triggered the development of the Southeast Asian petrochemical industry. What happens in this space has direct and indirect consequences for the rest of the value chain, be it through energy availability, feedstock availability, or national economic performance. The energy sector remaining a linchpin of local economies; in Malaysia, for instance, it accounts for about a fifth of annual GDP. Another impact of the growth of the O&G sector in Southeast Asia is that it promotes energy hubs in the region, particularly in Kuala Lumpur. Top-level expertise concentrated in the city may stem from an oil and gas legacy, but it is spreading in cutting-edge decarbonization knowledge replicable at multiple levels in the hydrocarbon value chain. “A person who has worked on a platform can easily switch to working on a carbon capture project,” said Charles Pfauwadel, senior vice president for Asia at Airswift, a global recruitment firm.

Image by Anoop VS at Pexels

Humans seem to be programmed to prioritize the present over the future, at least when it comes to dealing with crises. Between struggling with access to energy today and imagining the adverse impacts of climate change in the all-so-vague tomorrow, most would say ‘Let’s tackle one thing at a time.’ Twenty years from now, our older selves and new generations will likely be blaming us for not doing more to combat global warming, but in 2024, the energy crisis was a hard-to-digest reminder that the world is still hooked on fossil fuels. The oil and gas industry climbed out of an era of downturn, emerging stronger than ever.

Surprisingly or not, the world’s supposedly dying industry is currently the most profitable one. The oil and gas (O&G) exploration and production (EP) sector cashed in US$5.3 trillion between 2018-2023, more than any other sector. The global energy crisis that started in 2022 bumped up revenues to a 10-year high that year, a record that was broken again in 2023. Emissions grew too, reaching 12.1 billion tpa in 2023 – about a third of all industrial emissions – according to the Global Carbon Project.

The geopolitical train of events culminating in worries around energy security saw investors paddling back on climate worries and forward on petro-gas dollars. Within this global re-awakening to oil and gas, investment in Southeast Asia’s O&G development is booming, from US$9.5 billion in 2022-2023 to US$30 billion in the 2024-2025 period, informs intelligence company Rystad Energy. That would set the industry growing by 4% for the next five years, according to Energy Council. Another source, EcoBusiness News, estimated that China and Southeast Asia are leading global O&G developments in Asia, the continent accounting for two-thirds of the world’s total.

High GDP growth, industrialization and a slower electrification pace compared to the rest of the world explain why the region emerges as a very large and growing energy user. In a “stated policy scenario,” IEA anticipates total consumption in Southeast Asia will rise by 80% by 2050. That trend contrasts with the rest of the world: “Energy demand in Southeast Asia is set to nearly double over the coming few decades, while in the rest of the world energy demand is getting close to the peak and will flatten, as GDP growth and energy demand start decoupling due to greater energy efficiencies. Unlike other regions, Southeast Asian countries will not only have to decarbonize existing energy supply but also find a way to meet this huge growth in energy demand,” explained James Laybourn, APAC regional sales director for DNV Energy Systems, an energy advisory.

What also attracts investment to Southeast Asia is the region’s legacy and maturity in oil and gas. Outputs in the largest producing countries for oil (Indonesia, Malaysia, and Vietnam) and gas (Indonesia, Malaysia, and Thailand) had been declining, mostly on account of a low-price environment in fields that are generally offshore and more costly to develop and operate. Climate pressures also put off investors. Across the region, 4.861 million boed of crude, condensate, and natural gas were produced in 2023, according to GlobalData. That number is expected to spike, with CapEx doubling by 2027. Over the last five years, 7 billion barrels of oil were discovered in the region, 2 billion of which just last year, writes Upstream Online.

A flurry of major discoveries lit up investors’ interest in Southeast Asia, driving exploration and development work. One of them is Mubadala Energy’s Layaran and Tangkulo gas discovery at the South Andaman Block, which stoked enthusiasm for the broader acreage on the island of Sumatra, Indonesia. Italian energy group Eni also announced last year a big gas discovery from a well in North Ganal PSC, off the coast of East Kalimantan, Indonesia, with preliminary estimates of 5 trillion cubic feet (tcf) of gas and estimated condensate of up to 400 million barrels. In Malaysia, the country’s national energy company, Petronas, is preparing to bring Kasawari to production this year, a gas field discovered in 2011, while Shell’s Rosmari-Marjoram has also reached a final investment decision in 2022, eight years after being discovered. These last two make the largest gas fields in the country.

The offshore Serawak basin, where both of these projects are located, is a focal exploration area, with more projects in the pipeline: Petronas Carigali, the upstream company of state-owned Petronas, is to appraise its 2023 Singsing discovery in the Western Luconia, while PTTEP, the upstream business of Thai national energy company PTT, is looking to drill an appraisal well on the Chenda oil and gas discovery offshore Sarawak, made in 2023, as part of a cluster development with two other discoveries. Shell is also active, with extensive exploration and development drilling on the MLNG block, offshore Sarawak.

The region’s O&G sector is led by state-owned, upstream-to-downstream integrated companies: Petronas in Malaysia; PTT in Thailand; Pertamina in Indonesia; PetroVietnam; and PNOC in the Philippines. They work across borders and often together, despite being competitors in the petrochemical space. For instance, PTT is heavily invested in Malaysia, while Malaysia’s Petronas is active in Indonesia. Some companies are operating in shared waters, like Malaysian-listed Hibiscus Petroleum, which recently made a second discovery on oil Block PM3 CAA in the Malaysia-Vietnam commercial agreement area. But the big dollars are sought out from large foreign investors.

Petronas has recently awarded production-sharing agreements for six exploration blocks in the 2023 bidding round, as well as launching a new round for another 10 blocks this year. Malaysia has recently signed multiple MoUs with China’s Sinopec to explore crude oil, LNG, and petrochemical opportunities in the region, and has engaged Japanese companies on CCS. French major TotalEnergies has recently bought the full shares of SapuraOMV, a gas producer with a 40% stake in Block SK408 and a 30% stake in Block SK310, both in offshore Sarawak, Malaysia. American supermajor Chevron has acquired Hess, with assets in Malaysia. According to Petronas public documents, Malaysia’s goal of maintaining 2 million barrels of oil equivalent per day by 2025 will be supported through a pipeline of projects including Kasawari, Jerun, Rosmari-Marjoram and Lang Lebah in Sarawak, Gumusut-Kakap Redev and Belud Clusters in Sabah, and Bekok Oil Redev, Tabu Redev and Seligi Redev in Peninsular Malaysia. 25 wells are forecast to be drilled every year in the shallow waters of Malaysia and 45 upstream projects to be executed, together with four Central Processing Platforms (CPPs), three onshore facilities, and 1,130 km of pipelines to be fabricated.

On its side, Indonesia will auction 10 blocks this year in the North Sumatra basin, where Mubadala has recently made its discovery. One of the companies taking up acreage from Indonesia’s 2023 bidding round was Petronas, awarded with the Bobora production sharing contract offshore in Papua Barat province in the east of the country. Indonesia is leveraging recent discoveries as well as reformed fiscal policies to attract new investment in the North Sumatra basin. Last year, Indonesia drilled only 20 wells, but plans to double that number this year, writes Energy Council. Over the past decade, exploration plunged by about 23%, and the number of wells also fell from 64 in 2014 to 30 in 2022. Pertamina has teamed up with Italian energy company Eni in a new MoU to explore the potential of several blocks and signed another MoU with UK company Conrad to look together at the potential commercialization of two offshore licenses that Conrad has in the Aceh region. Eni has acquired Neptune’s entire portfolio minus Norway, including Eni-operated Geng North-1 gas discovery, offshore Indonesia. Indonesia has a goal to lift 1 million bpd and 12 billion cf/d of gas by 2030.

With the rises in oil prices, projects became more economic, but the other catalyst to new development is carbon economics, especially for gas fields. Typically, gas fields with high CO2 content have a lower chance of being brought to production. A solution was found in carbon capture and storage (CCS), which changes project credentials. For instance, Petronas’ Kasawari can be said to not only produce 900 million standard cubic feet per day of gas and 3.5 million barrels of condensate per day but also to capture up to 3.3 million tons of carbon dioxide. Petronas Carigali and JX Nippon Oil and Gas have also committed to an integrated offshore gas plus carbon capture and storage solution in the BIGST project, Malaysia’s next largest gas development after Kasawari, covering 4 trillion cubic feet of gas with a high CO2 content, the reason why it was never developed. A project’s flaw turns into an opportunity to store its own emissions, and, with potential scale-ups, emissions not of its making.

Because it burns more cleanly compared to oil and coal, gas is considered the lesser evil in the fossil fuel club. CCS is meant to make it even cleaner. By making use of saline aquifers and depleted oil and gas reservoirs for storage, CCS also provides a “reuse” opportunity in the context of circularity, which gives it extra credit. In Indonesia, the Ministry of energy and Natural Resources reported the country has a storage potential of 572 gigatons of CO2 in saline aquifers and an additional 4.85 gigatons of CO2 in depleted oil and gas reservoirs for CCS initiatives, as reported by S&P Global.

However, the compression of CO2 into a liquid pumped underground resembles an awful lot to brushing the trash under the carpet, some skeptics will say, which makes the technology controversial. It is feared that CCS will be treated as a quick fix that gives a free pass on more fossil fuel reliance and exploitation. That said, deploying CCS in a package with gas projects could be a starting point for self-standing CCS. James Laybourn, regional sales director for APAC at DNV Energy, explained: “The costs of the capture and sequestration are covered by the project. Whilst not directly contributing to global decarbonization efforts, an advantage of such projects is that they are already economically viable and once developed, they can potentially be used to support storage for other sources of CO2.”

Whereas Vietnam and Indonesia are focusing more on renewables, Malaysia is becoming one of the frontier appliers of CCS technology. Petronas is up to spending US$450 million on CCUS projects between 2023 and 2026, according to Rystad Energy. Regulators are also moving in that direction, requesting new developments to come with a carbon abatement strategy in place. “In many cases, investment approvals are contingent on CCS facilities built in parallel or as the next phase of a project. Gas projects are prioritized over oil, and those gas projects with a lower sulfur content are prioritized over those with a higher one. Yes, we see higher spending in the industry, which I believe is here to stay for the next five or so years, but with it, we also see a focus on leveraging low-carbon technologies for sustainable project delivery,” said Mahesh Swaminathan, Mahesh Swaminathan, EXCOM member and Senior VP Subsea and Floating Facilities, McDermott, a global EPC with regional headquarters in Kuala Lumpur, Malaysia.

Engineering, construction and procurement (EPC) as well as oilfield service (OFS) companies are very busy these days in Southeast Asia, not only on the traditional projects in the lifecycle of the oil and gas space – exploration, development, production, and decommissioning – but also on CCS, renewables, battery storage, hydrogen, and other low-carbon or carbon-abatement technologies. Service providers are bullish on both old and new types of projects. McDermott anticipates that up to 80% of demand will come from Australasia over the next 3-5 years. ABL sees a high increase in green-type projects, along with the usual ones: “2030 is only six years away, leaving a short timeframe to invest and execute projects that will allow Malaysia to meet its carbon commitments. Projects in carbon capture, floating solar, green hydrogen, and battery energy storage systems (BESS) are expected to grow in number and generate demand,” said Mohd Saifuddin Md Salleh, country manager for ABL Malaysia.

The service provider industry is putting its feet in both camps: the traditional development of oil and gas projects and related facilities, as well as new areas like hydrogen, CCS, or decommissioning and repurposing work on abandoned assets. In Malaysia alone, there are 130 wells and 50 facilities that need to be plugged out, according to Petronas. To serve both categories, the sector has seen some major re-restructuring. A good example is TechnipFMC, which spun off Technip Energies, the first dealing more with traditional LNG and ethylene business, and the latter taking up green hydrogen, plastic pyrolysis, sustainable chemistries, biofuels, waste, and carbon management, with flagship projects such as the Neste refinery in Singapore, among others. McDermott reorganized two years ago from a regional to a vertical-by-vertical structure, across multiple business lines; with that, Malaysia turned into a major global hub serving Australasia, West Africa, and the Americas. Global management consultancy firm Bain & Company has brought together its oil and gas, chemicals, mining, utilities, and agriculture under one practice called Energy and Natural Resources, one of the firm’s top three globally.

This diversification in the service sector is a reflection of what their customers, the oil and gas companies, have done. Some of the largest oil and gas companies are also the largest investors in renewables. They are advocates of both traditional and new energies. As a result of this cross-pollination, it is harder to distinguish the different businesses, once more siloed.

The discovery of oil and gas (O&G) triggered the development of the Southeast Asian petrochemical industry. What happens in this space has direct and indirect consequences for the rest of the value chain, be it through energy availability, feedstock availability, or national economic performance. The energy sector remaining a linchpin of local economies; in Malaysia, for instance, it accounts for about a fifth of annual GDP. Another impact of the growth of the O&G sector in Southeast Asia is that it promotes energy hubs in the region, particularly in Kuala Lumpur. Top-level expertise concentrated in the city may stem from an oil and gas legacy, but it is spreading in cutting-edge decarbonization knowledge replicable at multiple levels in the hydrocarbon value chain. “A person who has worked on a platform can easily switch to working on a carbon capture project,” said Charles Pfauwadel, senior vice president for Asia at Airswift, a global recruitment firm.