Reaching for the moon?

Image courtesy of Kincora Copper

“Stepping into the Gobi feels like stepping on the surface of the moon,” this is how most people describe the cold Gobi Desert in southern Mongolia, home to most mines in the country. Others have compared it to Mars. In a recent encounter with Elon Musk, Mongolia’s Prime Minister Oyun-Erdene Luvsannamsrai encouraged the Tesla billionaire to study the arid land as a casebook for Mars, given Musk’s personal goals of eventually colonizing the red planet. They also talked about a potential joint research venture on the use of rare earths and other minerals needed in electric vehicles that Mongolia is believed to host. Both lines of conversation – going to Mars or extracting the earth’s rare elements from the Gobi – somehow feel equally far-fetched.

Many questions – and theories – arise when it comes to Mongolia’s battery metals potential. The Gobi is widely thought to hold lithium, graphite and rare earth elements (REE), among others. How much of these is not fully known. According to a 2009 estimation by the US Geological Survey, Mongolia should have 31 million tons of REE reserves, second only to China (44 million tons). Considering that Inner Mongolia, a Chinese autonomous territory, is the main global supplier of rare earths, with the Bayan Obo mine alone supplying up to 45% of the world’s 17 REEs, even a non-geologist will be tempted to guess at similar characteristics for Outer Mongolia. On the graphite and lithium reserves, there were no official estimates we could find.

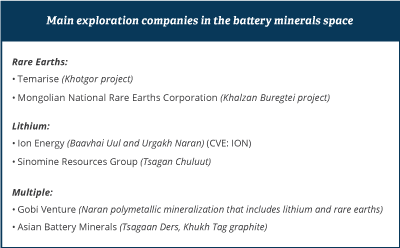

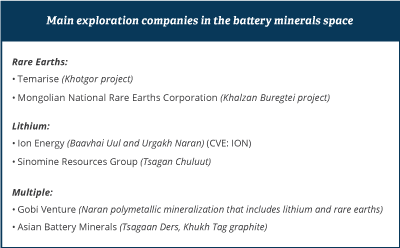

Out of Mongolia’s 80 REE occurrences and more than 280 mineralizations, as counted by Germany’s Federal Ministry for Economic Affairs and Climate Action (BMWK) in 2021, only three active explorers are looking at these, to our knowledge. One is Khotgor, which former Australian owner Parabellum Resources sold to Temarise in February 2024 for US$15 million. Located in the South Gobi, Khotgor is the only one, as far as we know, with a mineral resource estimate, completed earlier in 2023, which delineated a resource of 2 million tons with average NdPr grades of 20% REO. The other explorer actively advancing an early-stage light rare earths project is MNREC (Mongolian National Rare Earths Corporation) owned by the Trade and Development Bank (TDB). The Khalzan Buregtei project, in the far west of the country (Khovd province) was drilled back in 2012-2013 by its previous owners, an Australian company, and was taken over by TDB in 2015. The current owners completed another 20,000 m of drilling last year and expect to release a PFS in 2024.

Meanwhile, in lithium, one company carries the first-mover responsibility of proving Mongolia’s potential. Canada-listed Ion Energy has two projects in the country, the clay evaporite Baavhai Uul and the more advanced Urgakh Naran, with the potential to be a brine asset. Ion is currently in discussions with an earn-in partner that could inject more cash into developing the asset. “We are no longer looking to bring in a public equity investor, due to the dilution risks, but instead, an investor that buys into the asset with the obligation to perform exploration over several years with the option to acquire the remaining equity. That would leave ION Energy with an NSR. These conversations are ongoing,” said CEO Ali Haji.

In a more recent development, Chinese company Sinomine Resources Group has entered the lithium exploration scene in Mongolia through the acquisition of the Tsagan Chuluut project from local company Lithium Century for US$20 million. Though there is not enough data on the project, Sinomine told the Mongolian media that the project could contain reserves of 1.7 million tons lithium.

Two private junior companies are also looking at lithium on their respective licenses, but their focus on lithium is not exclusive: Gobi Venture has a multitude of metals to choose from at its Naran project in the Gobi area, among which it found an open lithium mineralization that the explorer plans to further investigate. Asian Battery Minerals has three different projects across commodities (lithium, graphite, copper-nickel) that it seeks to develop concomitantly. Its Tsagaan Ders lithium prospect in the Dundgobi region is early-stage, to be drilled later this year.

Asian Battery’s most advanced project is the Khukh Tag graphite project, which the company says is only 24 months away from a final investment decision. Khukh Tag is not only the most advanced graphite project in the country but also the only one we know of. Its total mineral resource is at 12.2 million tons at 12.3% grade. Gan-Ochir Zunduisuren, managing director of Asian Battery Minerals, told GBR that 2024 will be an important year for Khukh Tag, with planned high-impact drilling and infill drilling; by the second half of the year, the company also wants to have tested the material for suitability in battery anodes.

Investors require more geology and less mystery

Besides these prospects-turned-projects by the dozen players in lithium, graphite, and REE, there are multiple other occurrences and deposits documented in the country that are currently stagnant. The German Federal Institute for Geosciences and Natural Resources together with Mongolia’s Mineral Resource and Petroleum Authority (MRPAM) characterized two other carbonate-bearing deposits besides Khotgor (Mushgai Khudag and Lugiin Gol), as well as two more peralkaline deposits besides Khalzan Buregtei (Ulaan del and Tsagaan Chuluut), some of these being assessed as deposits of significant economic importance in previous studies. For lithium, Mongolia’s regulator, MRPAM, informs of two current deposits; Khukh Del, which appears to be held by state-owned company Mongolrostsvetmet, and Munkhtiin Tsagaan Durvuljin, for which we could not find more information. Together, they amount to a total resource of 203,000 t, according to MRPAM.

The problem is that many other licenses are held by private owners who do not have the skill, the will, or the money to do anything with them. Based on anonymous comments from insiders published by Newsbase, these licenses are used as collaterals for loans and there is little cooperation with the government on them. Our sources told us similar things. “In other jurisdictions, explorers take up a license for a limited time, and, if proven un-prospective, they give it back and take up another area, whereas, in Mongolia, licenses have turned into precious commodities themselves, sometimes held on to by people that lack the technical acumen to monetize their value and that treat the license just like they would treat a real estate property,” said Julien Lawrence, managing director of O2 Mining, shareholder and operator of the Chuulut fluorspar mine.

Without the explorers to study the grounds, the real potential of Mongolia’s battery metals space remains limited to the broad-scale data that geologists have provided to date. However, that data also has many gaps. Most existing targets today have been identified by Russian, Czech, Hungarian, and Polish geologists during socialist times, so the information is outdated. According to Geosan, a local airborne geophysics company, the government has conducted geological land surveys on a 1:200,000 scale across the entire territory, but only 40% of the land is covered by a more detailed 1:50,000 scale survey. Geosan itself provided airborne geophysical surveys over 20% of the country’s surface. The government is keen to change this, and aims that, by 2025, the remaining territory should be scanned on a closer 1:25,000 scale map. Local companies like integrated geospatial solutions company Geomaster will be participating in that tender.

For more specific geophysical information, the government has brought in Xcalibur Smart Mapping, a Spanish-based global leader in airborne and mapping geophysics: “Mongolia has had some traditional studies focused on surface geology in the mid-20th century, while some parts of the country have also been covered by airborne surveys, but the bulk of the data obtained would not meet what we call ‘modern’ industry standards. There is a gap in high-resolution magnetics and radiometric gravity data to get a picture of the subsurface potential,” said Bart Anderson, COO APAC for Xcalibur.

Xcalibur will partner Geological Research Center of Mongolia and the Ministry of Mines and Heavy Industry to conduct a Helitem electromagnetic survey covering the south of the country, followed by a Falcon survey. “The quickest and most environmentally friendly way governments can fast-track their understanding of their country’s natural capital is by mapping from the air. This has the lowest carbon and community impact while delivering the fastest results,” Anderson told GBR.

A bout of international interest

The geological and geophysical data gathered is hoped to help entice further investment by lowering the risks. Already, multiple countries have shown gestures of interest in Mongolia’s battery minerals space. Late last year, France signed a deal with Mongolia to explore a lithium-rich basin via the French Geological Study, also committing to investing over US$400,000. German chancellor Olaf Scholz also pledged to increase Germany’s involvement in the development of Mongolia’s critical minerals, especially copper and rare earths, back in 2022, but no further news has been heard since.

Rare earths have attracted the most attention, especially from the US and South Korea, which agreed with Mongolia to establish a Rare Metals Cooperation Center in Ulaanbaatar. South Korean telecommunications giant KT Corp signed an MoU with Mongolia to secure a stable supply of mineral resources, including REEs, and then signed another MoU with one of Mongolia’s largest corporations, Monnis Group, to cooperate on REE mining. Unfortunately, except for the French US$400,000 investment, these gestures of interest and formal memorandums remain just that – gestures – and some fear they are made to simply unnerve China, which controls the battery minerals value chain, a control that poses a great threat to global demand.

China seems unconcerned and is reassured by its power over battery minerals. In battery minerals supply chain speak, all roads lead to China, not just because China geographically bounds Mongolia’s borders to the south, but also because it has most of the knowledge and technology of battery minerals production. The US itself, so eager to unfasten itself from China, sources most of its REEs, graphite, and lithium from China. The Americans are looking at Mongolia as an alternative supply partner, but also at South Africa, the DRC, or Mexico, countries where Jose W. Fernandez, the US Assistant Secretary of State for Economic Energy & Business Affairs, has pilgrimaged recently, as well as in Mongolia.

“The Mongolian government seems to encourage investors from the US, Japan and Korea to come to Mongolia and secure the supply chain outside of China, yet it fails to consider that if the material is being processed in China, the whole point of a resilient supply chain that is independent of China is defeated. Also, producing oxide or carbonate of high content reduces the overall mass of the product, whereas bulk concentrate is, of course, much more voluminous, and costlier to transport,” said Purevtuvshin Tsooj, Project Leader at Mongolian National Rare Earths Corp (MNREC), the explorer advancing the Khalzan Buregtei project in Western Mongolia.

Better too early than too late

The obstacles to seeing a rare earths mining operation in Mongolia are many and needless to examine in detail. The development of battery minerals production in Mongolia would require the kind of investment environment, infrastructure, and specialist skills that Mongolia does not currently have. Investment coming in the form of offtake agreements would be unlikely for the early-stage projects, which is where most of Mongolia’s assets are at now. The potential backlash on mining REEs, which contain radioactive waste, would likely be fiercer than it has been for copper and other metals. Even if Mongolia succeeds in developing its first mine in lithium, rare earths, or graphite, the material produced would likely be sent to China for processing.

Solutions around these challenges exist. For instance, MNREC is considering producing 90% purity mixed rare earths dioxide or carbonate, rather than concentrate, which would both increase the value of the final product and allow the material to be shipped or flown further away, less constrained by the logistics cost. A joint processing plant fed by similar carbonatite-hosted deposits, like Khotgor (Temarise), Mushgai Khudag, and Lugiin Gol in the South Gobi, could also be a potential solution down the line. For now, lithium appears to be the most promising stride in the battery space, contingent on Ion Energy’s expected deal for an earn-in partner for Urgakh Naran.

To be part of the value chains of critical minerals, Mongolia has much work to do, from regulation to infrastructure and beyond. Or perhaps, it would take for China to do what the West fears it could – pressing the stop button on exports of critical materials like REEs. Nevertheless, Mongolia should insist on looking at its battery prospects to stay relevant. “Within the current mining sector, one big chunk is metallurgical coal, and the other big chunk is copper, with the remaining 10-15% of it being a mix of other metals, including gold. The energy transition risks putting about half of our industry at peril in the next few decades. Contradictorily, the country’s Vision 2050 sees the mining industry expanding up to four times its current value. So how are we to grow the industry from a base that is supposed to be phased out? The future lies in those critical minerals that we know exist in Mongolia, yet we have little visibility of their extent,” summarized Dagva Myagmarsuren the CEO of QMC (Qualified Management Consulting).

In an evolutionary line, if coal represents Mongolia’s beginning in mining, and copper and gold its most dynamic present, battery minerals could be its future, as distant as this may be now. The country has yet to develop a comprehensive critical mineral policy, strategy, and list. Dagva Myagmarsuren from the Critical Minerals Association said the Association drafted these documents and submitted them to the government. “Things move slowly, while the world is changing very fast for critical minerals. The question is, are we going to be too late?” he asked, mentioning other countries that are way ahead.

Before looking at mining the resources on Mars on the Moon, Mongolia has ready materials sleeping in the Gobi. Since the ‘easy’ resources have already been found in mature jurisdictions, investors are likely to take the risk and look at the least explored ones. Richard Bennett, executive chairman of London-listed Getech, which offers a geoscience knowledge platform (Globe), helps mining companies to answer “where in the world” questions, and it collaborated with Asian Battery Minerals in Mongolia. “Getech is particularly interested in people who are looking for new exploration areas. In the search for the best risk-reward ratio, companies will either go looking for low-hanging fruits in the more challenging jurisdictions or pursue more expensive resources in the tried-and-tested, less risky jurisdictions,” said Bennett.

Mining for battery minerals in Mongolia will not be easy, but, to quote Robert Friedland, who himself quoted President John F. Kennedy: “We choose to go to the moon not because it’s easy, but because it’s hard.”

Image courtesy of Kincora Copper

“Stepping into the Gobi feels like stepping on the surface of the moon,” this is how most people describe the cold Gobi Desert in southern Mongolia, home to most mines in the country. Others have compared it to Mars. In a recent encounter with Elon Musk, Mongolia’s Prime Minister Oyun-Erdene Luvsannamsrai encouraged the Tesla billionaire to study the arid land as a casebook for Mars, given Musk’s personal goals of eventually colonizing the red planet. They also talked about a potential joint research venture on the use of rare earths and other minerals needed in electric vehicles that Mongolia is believed to host. Both lines of conversation – going to Mars or extracting the earth’s rare elements from the Gobi – somehow feel equally far-fetched.

Many questions – and theories – arise when it comes to Mongolia’s battery metals potential. The Gobi is widely thought to hold lithium, graphite and rare earth elements (REE), among others. How much of these is not fully known. According to a 2009 estimation by the US Geological Survey, Mongolia should have 31 million tons of REE reserves, second only to China (44 million tons). Considering that Inner Mongolia, a Chinese autonomous territory, is the main global supplier of rare earths, with the Bayan Obo mine alone supplying up to 45% of the world’s 17 REEs, even a non-geologist will be tempted to guess at similar characteristics for Outer Mongolia. On the graphite and lithium reserves, there were no official estimates we could find.

Out of Mongolia’s 80 REE occurrences and more than 280 mineralizations, as counted by Germany’s Federal Ministry for Economic Affairs and Climate Action (BMWK) in 2021, only three active explorers are looking at these, to our knowledge. One is Khotgor, which former Australian owner Parabellum Resources sold to Temarise in February 2024 for US$15 million. Located in the South Gobi, Khotgor is the only one, as far as we know, with a mineral resource estimate, completed earlier in 2023, which delineated a resource of 2 million tons with average NdPr grades of 20% REO. The other explorer actively advancing an early-stage light rare earths project is MNREC (Mongolian National Rare Earths Corporation) owned by the Trade and Development Bank (TDB). The Khalzan Buregtei project, in the far west of the country (Khovd province) was drilled back in 2012-2013 by its previous owners, an Australian company, and was taken over by TDB in 2015. The current owners completed another 20,000 m of drilling last year and expect to release a PFS in 2024.

Meanwhile, in lithium, one company carries the first-mover responsibility of proving Mongolia’s potential. Canada-listed Ion Energy has two projects in the country, the clay evaporite Baavhai Uul and the more advanced Urgakh Naran, with the potential to be a brine asset. Ion is currently in discussions with an earn-in partner that could inject more cash into developing the asset. “We are no longer looking to bring in a public equity investor, due to the dilution risks, but instead, an investor that buys into the asset with the obligation to perform exploration over several years with the option to acquire the remaining equity. That would leave ION Energy with an NSR. These conversations are ongoing,” said CEO Ali Haji.

In a more recent development, Chinese company Sinomine Resources Group has entered the lithium exploration scene in Mongolia through the acquisition of the Tsagan Chuluut project from local company Lithium Century for US$20 million. Though there is not enough data on the project, Sinomine told the Mongolian media that the project could contain reserves of 1.7 million tons lithium.

Two private junior companies are also looking at lithium on their respective licenses, but their focus on lithium is not exclusive: Gobi Venture has a multitude of metals to choose from at its Naran project in the Gobi area, among which it found an open lithium mineralization that the explorer plans to further investigate. Asian Battery Minerals has three different projects across commodities (lithium, graphite, copper-nickel) that it seeks to develop concomitantly. Its Tsagaan Ders lithium prospect in the Dundgobi region is early-stage, to be drilled later this year.

Asian Battery’s most advanced project is the Khukh Tag graphite project, which the company says is only 24 months away from a final investment decision. Khukh Tag is not only the most advanced graphite project in the country but also the only one we know of. Its total mineral resource is at 12.2 million tons at 12.3% grade. Gan-Ochir Zunduisuren, managing director of Asian Battery Minerals, told GBR that 2024 will be an important year for Khukh Tag, with planned high-impact drilling and infill drilling; by the second half of the year, the company also wants to have tested the material for suitability in battery anodes.

Investors require more geology and less mystery

Besides these prospects-turned-projects by the dozen players in lithium, graphite, and REE, there are multiple other occurrences and deposits documented in the country that are currently stagnant. The German Federal Institute for Geosciences and Natural Resources together with Mongolia’s Mineral Resource and Petroleum Authority (MRPAM) characterized two other carbonate-bearing deposits besides Khotgor (Mushgai Khudag and Lugiin Gol), as well as two more peralkaline deposits besides Khalzan Buregtei (Ulaan del and Tsagaan Chuluut), some of these being assessed as deposits of significant economic importance in previous studies. For lithium, Mongolia’s regulator, MRPAM, informs of two current deposits; Khukh Del, which appears to be held by state-owned company Mongolrostsvetmet, and Munkhtiin Tsagaan Durvuljin, for which we could not find more information. Together, they amount to a total resource of 203,000 t, according to MRPAM.

The problem is that many other licenses are held by private owners who do not have the skill, the will, or the money to do anything with them. Based on anonymous comments from insiders published by Newsbase, these licenses are used as collaterals for loans and there is little cooperation with the government on them. Our sources told us similar things. “In other jurisdictions, explorers take up a license for a limited time, and, if proven un-prospective, they give it back and take up another area, whereas, in Mongolia, licenses have turned into precious commodities themselves, sometimes held on to by people that lack the technical acumen to monetize their value and that treat the license just like they would treat a real estate property,” said Julien Lawrence, managing director of O2 Mining, shareholder and operator of the Chuulut fluorspar mine.

Without the explorers to study the grounds, the real potential of Mongolia’s battery metals space remains limited to the broad-scale data that geologists have provided to date. However, that data also has many gaps. Most existing targets today have been identified by Russian, Czech, Hungarian, and Polish geologists during socialist times, so the information is outdated. According to Geosan, a local airborne geophysics company, the government has conducted geological land surveys on a 1:200,000 scale across the entire territory, but only 40% of the land is covered by a more detailed 1:50,000 scale survey. Geosan itself provided airborne geophysical surveys over 20% of the country’s surface. The government is keen to change this, and aims that, by 2025, the remaining territory should be scanned on a closer 1:25,000 scale map. Local companies like integrated geospatial solutions company Geomaster will be participating in that tender.

For more specific geophysical information, the government has brought in Xcalibur Smart Mapping, a Spanish-based global leader in airborne and mapping geophysics: “Mongolia has had some traditional studies focused on surface geology in the mid-20th century, while some parts of the country have also been covered by airborne surveys, but the bulk of the data obtained would not meet what we call ‘modern’ industry standards. There is a gap in high-resolution magnetics and radiometric gravity data to get a picture of the subsurface potential,” said Bart Anderson, COO APAC for Xcalibur.

Xcalibur will partner Geological Research Center of Mongolia and the Ministry of Mines and Heavy Industry to conduct a Helitem electromagnetic survey covering the south of the country, followed by a Falcon survey. “The quickest and most environmentally friendly way governments can fast-track their understanding of their country’s natural capital is by mapping from the air. This has the lowest carbon and community impact while delivering the fastest results,” Anderson told GBR.

A bout of international interest

The geological and geophysical data gathered is hoped to help entice further investment by lowering the risks. Already, multiple countries have shown gestures of interest in Mongolia’s battery minerals space. Late last year, France signed a deal with Mongolia to explore a lithium-rich basin via the French Geological Study, also committing to investing over US$400,000. German chancellor Olaf Scholz also pledged to increase Germany’s involvement in the development of Mongolia’s critical minerals, especially copper and rare earths, back in 2022, but no further news has been heard since.

Rare earths have attracted the most attention, especially from the US and South Korea, which agreed with Mongolia to establish a Rare Metals Cooperation Center in Ulaanbaatar. South Korean telecommunications giant KT Corp signed an MoU with Mongolia to secure a stable supply of mineral resources, including REEs, and then signed another MoU with one of Mongolia’s largest corporations, Monnis Group, to cooperate on REE mining. Unfortunately, except for the French US$400,000 investment, these gestures of interest and formal memorandums remain just that – gestures – and some fear they are made to simply unnerve China, which controls the battery minerals value chain, a control that poses a great threat to global demand.

China seems unconcerned and is reassured by its power over battery minerals. In battery minerals supply chain speak, all roads lead to China, not just because China geographically bounds Mongolia’s borders to the south, but also because it has most of the knowledge and technology of battery minerals production. The US itself, so eager to unfasten itself from China, sources most of its REEs, graphite, and lithium from China. The Americans are looking at Mongolia as an alternative supply partner, but also at South Africa, the DRC, or Mexico, countries where Jose W. Fernandez, the US Assistant Secretary of State for Economic Energy & Business Affairs, has pilgrimaged recently, as well as in Mongolia.

“The Mongolian government seems to encourage investors from the US, Japan and Korea to come to Mongolia and secure the supply chain outside of China, yet it fails to consider that if the material is being processed in China, the whole point of a resilient supply chain that is independent of China is defeated. Also, producing oxide or carbonate of high content reduces the overall mass of the product, whereas bulk concentrate is, of course, much more voluminous, and costlier to transport,” said Purevtuvshin Tsooj, Project Leader at Mongolian National Rare Earths Corp (MNREC), the explorer advancing the Khalzan Buregtei project in Western Mongolia.

Better too early than too late

The obstacles to seeing a rare earths mining operation in Mongolia are many and needless to examine in detail. The development of battery minerals production in Mongolia would require the kind of investment environment, infrastructure, and specialist skills that Mongolia does not currently have. Investment coming in the form of offtake agreements would be unlikely for the early-stage projects, which is where most of Mongolia’s assets are at now. The potential backlash on mining REEs, which contain radioactive waste, would likely be fiercer than it has been for copper and other metals. Even if Mongolia succeeds in developing its first mine in lithium, rare earths, or graphite, the material produced would likely be sent to China for processing.

Solutions around these challenges exist. For instance, MNREC is considering producing 90% purity mixed rare earths dioxide or carbonate, rather than concentrate, which would both increase the value of the final product and allow the material to be shipped or flown further away, less constrained by the logistics cost. A joint processing plant fed by similar carbonatite-hosted deposits, like Khotgor (Temarise), Mushgai Khudag, and Lugiin Gol in the South Gobi, could also be a potential solution down the line. For now, lithium appears to be the most promising stride in the battery space, contingent on Ion Energy’s expected deal for an earn-in partner for Urgakh Naran.

To be part of the value chains of critical minerals, Mongolia has much work to do, from regulation to infrastructure and beyond. Or perhaps, it would take for China to do what the West fears it could – pressing the stop button on exports of critical materials like REEs. Nevertheless, Mongolia should insist on looking at its battery prospects to stay relevant. “Within the current mining sector, one big chunk is metallurgical coal, and the other big chunk is copper, with the remaining 10-15% of it being a mix of other metals, including gold. The energy transition risks putting about half of our industry at peril in the next few decades. Contradictorily, the country’s Vision 2050 sees the mining industry expanding up to four times its current value. So how are we to grow the industry from a base that is supposed to be phased out? The future lies in those critical minerals that we know exist in Mongolia, yet we have little visibility of their extent,” summarized Dagva Myagmarsuren the CEO of QMC (Qualified Management Consulting).

In an evolutionary line, if coal represents Mongolia’s beginning in mining, and copper and gold its most dynamic present, battery minerals could be its future, as distant as this may be now. The country has yet to develop a comprehensive critical mineral policy, strategy, and list. Dagva Myagmarsuren from the Critical Minerals Association said the Association drafted these documents and submitted them to the government. “Things move slowly, while the world is changing very fast for critical minerals. The question is, are we going to be too late?” he asked, mentioning other countries that are way ahead.

Before looking at mining the resources on Mars on the Moon, Mongolia has ready materials sleeping in the Gobi. Since the ‘easy’ resources have already been found in mature jurisdictions, investors are likely to take the risk and look at the least explored ones. Richard Bennett, executive chairman of London-listed Getech, which offers a geoscience knowledge platform (Globe), helps mining companies to answer “where in the world” questions, and it collaborated with Asian Battery Minerals in Mongolia. “Getech is particularly interested in people who are looking for new exploration areas. In the search for the best risk-reward ratio, companies will either go looking for low-hanging fruits in the more challenging jurisdictions or pursue more expensive resources in the tried-and-tested, less risky jurisdictions,” said Bennett.

Mining for battery minerals in Mongolia will not be easy, but, to quote Robert Friedland, who himself quoted President John F. Kennedy: “We choose to go to the moon not because it’s easy, but because it’s hard.”