What happened to ‘Minegolia’?

Image courtesy of Oyu Tolgoi

The discovery of Oyu Tolgoi in 2001 changed Mongolia forever, and in more ways than the geologists at the site, headed by the since-turned-billionaire Robert Friedland, could have imagined when they first came across the large copper and gold deposit in the Gobi Desert. “Turquoise Hill,” a literal translation of “Oyu Tolgoi,” inspired by the color of the oxide copper, gave rise to ‘Minegolia’, the nickname that stuck for the best part of the mining boom years, until 2013.

At the turn of the century, Mongolia had just transitioned into a free-market economy following the fall of the USSR, and had more horses than cars (or people, for that matter). Most of its income came from nomadic herding across its vast lands. But it was the underbelly of the steppe that would drive its future forward. The US$1 billion economy had US$1 trillion in mineral resources. This huge potential was punctuated by the Oyu Tolgoi discovery. Even if at first, the news of the discovery went unnoticed because it was announced on the tragic day of 11th September 2001, over the years, finding one of the world’s largest copper-gold deposits became an exploration sensation that would attract many others looking for the same thing.

What happened between 2006-2013 in Mongolia has been compared to the Californian Gold Rush in the 19th century or the Australian commodity boom in the 1930s. The formerly little-known Soviet satellite country became a magnet for miners and investors, many from Canada and Australia. The capital, Ulaanbaatar (UB), was abuzz with new people and new money, luxury stores, hotels, cars, and restaurants were springing up around the city. UB grew by 70%, becoming home to almost half of the country’s population. Outside the hustle of the city, about 800 km drive through the steppe, 16,000 people were working at the OT site, once one of the least populated regions in the country; they were housed in traditional gers (or tents) equipped with modern facilities.

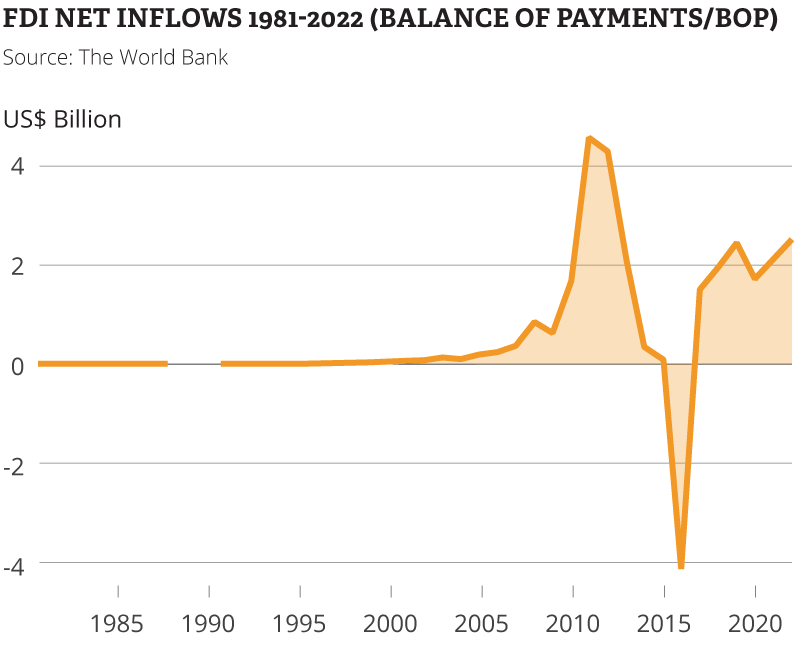

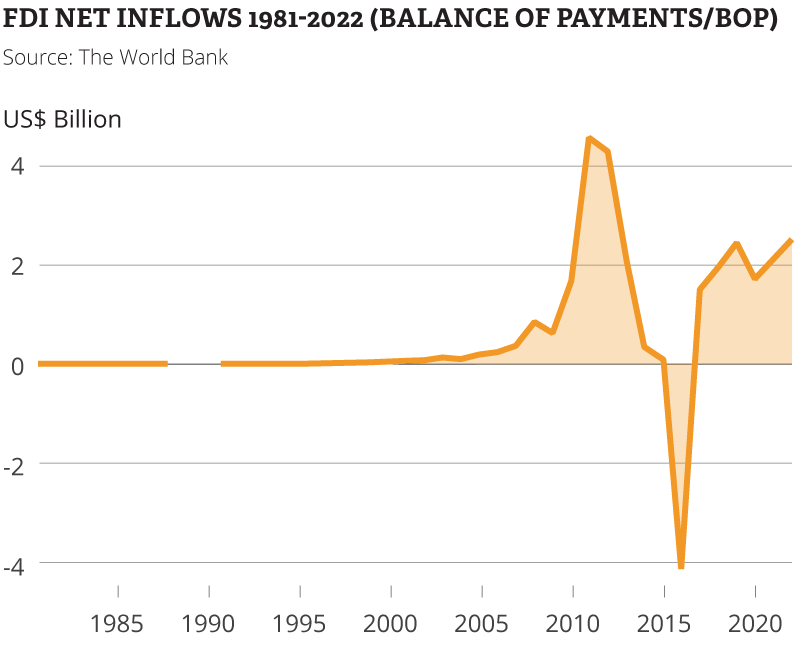

For the population, old and new, hope and caution were mixing in an intoxicating way. Rural people felt the traditional way of life threatened. For others, the opportunity was too good to miss. Friedland’s Ivanhoe together with its new partner, Australian mining giant Rio Tinto, had already invested US$3 billion by the end of 2012, eventually spending a total of US$10 billion by 2020 to put the underground of the OT into production. Mongolia had become the fastest-growing economy in the world, and the IMF was projecting continued double-digit growth and the potential for the country to double its GDP within the decade. FDI inflows spiked, reaching a peak in 2011 at US$4.57 billion – 43% of the country’s GDP, according to Macrotrends data. Mining already constituted a third of the country’s GDP.

Other international players like Centerra Gold and big names like BHP joined the search for minerals, and 3,000 exploration licenses were active by 2012, according to the Economist. ‘Minegolia’ was born.

By 2014, everything changed. Most investors fled, Friedland included, leaving the OT with Rio Tinto. About half of the 12,000 expats that had been in Mongolia in 2012 were gone by 2015, according to Globe and Mail. FDI fell sharply, hitting a low of (minus) – US$4.16 billion in 2016. The following year, the economy hit rock bottom, its fiscal, sovereign, and banking sectors collapsed, and public debt ballooned. Mongolia was rescued by an IMF bailout, one of the largest in the organization’s portfolio (in rapport to a country’s GDP.)

Some blamed the commodity downcycle that affected the mining industry globally; others blamed the dispute with the OT, which entered a standoff with the government, sending a chilling effect to other investors. The unfriendly policies that the newly elected government passed to appease strong anti-mining sentiment expressed by the electorate scared investors. Or perhaps the young democracy simply fell victim to the resource curse or ‘Dutch disease’, when the blessings of resource wealth turn into a curse of spending-beyond-means, out-of-control inflation, and an eventual boom and bust.

No one speaks about ‘Minegolia’ anymore, even though the country derives 90% of its exports and 25% of its GDP from minerals. What Mongolians do talk about is redeeming the mistakes made in the past. After a rush and a crash, the industry shrunk considerably and faced multiple hurdles between 2017 and 2022: A pandemic, a recession, and the ripple impacts of sanctions on neighboring Russia. The country has adopted a more sober approach to mining, learning not to take investment for granted, while also understanding that Mongolia is much more than mining, and inherently much more than ‘Minegolia’. Therefore, it must not solely depend on the industry.

In 2023, the stars have started to align again, with the OT’s long-anticipated underground development finally complete and prepared for the ramp-up to over 500,000 t/y of copper, which would make it one of the world’s largest mines, as was long promised. Record exports of coal have also strengthened the country’s balance sheet, and a more pro-mining government elected in 2020 has worked to deliver a new mining code before the next elections this year.

The industry remains imbalanced, between three megamoth mines (OT and Erdenet for copper, and Erdenes Tavan Tolgoi for coal) and around 20 juniors looking at a basket of commodities, from coal, copper, and gold, to lithium, rare earths, and graphite. A large share of producing companies remain in the hands of the state, a trend that has only worsened in recent years. But there are also positive signs of new private players, especially in copper and gold, signing more transactions over the last two years. The next foreign-led multi-billion investment is also in the pipeline, this time in uranium, with Orano in talks with the Mongolian government for a final investment decision in Zuuvch Ovoo. That would make Mongolia into a diversified, four-mega-mines land.

In the following articles, we will take a closer look at what Mongolia is doing to get it right this time, by tackling anti-mining sentiment and nationalism, improving regulations, and reducing its dependencies on both its neighbors and mining itself. The following pages should explain in greater detail what happened to ‘Minegolia’.

Image courtesy of Oyu Tolgoi

The discovery of Oyu Tolgoi in 2001 changed Mongolia forever, and in more ways than the geologists at the site, headed by the since-turned-billionaire Robert Friedland, could have imagined when they first came across the large copper and gold deposit in the Gobi Desert. “Turquoise Hill,” a literal translation of “Oyu Tolgoi,” inspired by the color of the oxide copper, gave rise to ‘Minegolia’, the nickname that stuck for the best part of the mining boom years, until 2013.

At the turn of the century, Mongolia had just transitioned into a free-market economy following the fall of the USSR, and had more horses than cars (or people, for that matter). Most of its income came from nomadic herding across its vast lands. But it was the underbelly of the steppe that would drive its future forward. The US$1 billion economy had US$1 trillion in mineral resources. This huge potential was punctuated by the Oyu Tolgoi discovery. Even if at first, the news of the discovery went unnoticed because it was announced on the tragic day of 11th September 2001, over the years, finding one of the world’s largest copper-gold deposits became an exploration sensation that would attract many others looking for the same thing.

What happened between 2006-2013 in Mongolia has been compared to the Californian Gold Rush in the 19th century or the Australian commodity boom in the 1930s. The formerly little-known Soviet satellite country became a magnet for miners and investors, many from Canada and Australia. The capital, Ulaanbaatar (UB), was abuzz with new people and new money, luxury stores, hotels, cars, and restaurants were springing up around the city. UB grew by 70%, becoming home to almost half of the country’s population. Outside the hustle of the city, about 800 km drive through the steppe, 16,000 people were working at the OT site, once one of the least populated regions in the country; they were housed in traditional gers (or tents) equipped with modern facilities.

For the population, old and new, hope and caution were mixing in an intoxicating way. Rural people felt the traditional way of life threatened. For others, the opportunity was too good to miss. Friedland’s Ivanhoe together with its new partner, Australian mining giant Rio Tinto, had already invested US$3 billion by the end of 2012, eventually spending a total of US$10 billion by 2020 to put the underground of the OT into production. Mongolia had become the fastest-growing economy in the world, and the IMF was projecting continued double-digit growth and the potential for the country to double its GDP within the decade. FDI inflows spiked, reaching a peak in 2011 at US$4.57 billion – 43% of the country’s GDP, according to Macrotrends data. Mining already constituted a third of the country’s GDP.

Other international players like Centerra Gold and big names like BHP joined the search for minerals, and 3,000 exploration licenses were active by 2012, according to the Economist. ‘Minegolia’ was born.

By 2014, everything changed. Most investors fled, Friedland included, leaving the OT with Rio Tinto. About half of the 12,000 expats that had been in Mongolia in 2012 were gone by 2015, according to Globe and Mail. FDI fell sharply, hitting a low of (minus) – US$4.16 billion in 2016. The following year, the economy hit rock bottom, its fiscal, sovereign, and banking sectors collapsed, and public debt ballooned. Mongolia was rescued by an IMF bailout, one of the largest in the organization’s portfolio (in rapport to a country’s GDP.)

Some blamed the commodity downcycle that affected the mining industry globally; others blamed the dispute with the OT, which entered a standoff with the government, sending a chilling effect to other investors. The unfriendly policies that the newly elected government passed to appease strong anti-mining sentiment expressed by the electorate scared investors. Or perhaps the young democracy simply fell victim to the resource curse or ‘Dutch disease’, when the blessings of resource wealth turn into a curse of spending-beyond-means, out-of-control inflation, and an eventual boom and bust.

No one speaks about ‘Minegolia’ anymore, even though the country derives 90% of its exports and 25% of its GDP from minerals. What Mongolians do talk about is redeeming the mistakes made in the past. After a rush and a crash, the industry shrunk considerably and faced multiple hurdles between 2017 and 2022: A pandemic, a recession, and the ripple impacts of sanctions on neighboring Russia. The country has adopted a more sober approach to mining, learning not to take investment for granted, while also understanding that Mongolia is much more than mining, and inherently much more than ‘Minegolia’. Therefore, it must not solely depend on the industry.

In 2023, the stars have started to align again, with the OT’s long-anticipated underground development finally complete and prepared for the ramp-up to over 500,000 t/y of copper, which would make it one of the world’s largest mines, as was long promised. Record exports of coal have also strengthened the country’s balance sheet, and a more pro-mining government elected in 2020 has worked to deliver a new mining code before the next elections this year.

The industry remains imbalanced, between three megamoth mines (OT and Erdenet for copper, and Erdenes Tavan Tolgoi for coal) and around 20 juniors looking at a basket of commodities, from coal, copper, and gold, to lithium, rare earths, and graphite. A large share of producing companies remain in the hands of the state, a trend that has only worsened in recent years. But there are also positive signs of new private players, especially in copper and gold, signing more transactions over the last two years. The next foreign-led multi-billion investment is also in the pipeline, this time in uranium, with Orano in talks with the Mongolian government for a final investment decision in Zuuvch Ovoo. That would make Mongolia into a diversified, four-mega-mines land.

In the following articles, we will take a closer look at what Mongolia is doing to get it right this time, by tackling anti-mining sentiment and nationalism, improving regulations, and reducing its dependencies on both its neighbors and mining itself. The following pages should explain in greater detail what happened to ‘Minegolia’.