Copper margins shrink as costs rise

Image courtesy of Anglo American

Peru’s top 10 copper producers have remained consistent, but notable rankings have changed. Cerro Verde has now taken the lead as the primary copper producer, experiencing a 1.6% increase in output (466,463 mt/y compared to the 459,100 mt/y produced in 2022). In contrast, Antamina, which held the top position in 2022, saw a 7% decrease, from almost 468,000 mt/y to 435,378 mt/y.

Southern Peru maintains its third-place position, showing a significant 9.4% increase to 374,189 mt/y from the 341,898 mt/y produced in 2022. Anglo American’s Quellaveco presented a 219.9% increase, becoming the fourth-largest copper producer in Peru, having produced 319,061 mt/y of copper. The mine was brought online in late 2022, so it must be noted that this uptick in production is logical, though crucial for Peru.

Las Bambas demonstrated a 18.5% increase, following a challenging first half of 2023, with operations picking up swiftly. The mine, operated by the Chinese MMG has produced 302,039 mt/y of copper in 2023 (vs 254,712 mt/y in 2022). On the contrary, Chinalco experienced an 18.1% decrease (200,317 mt/y in 2023 compared to 244,712 mt/y in 2022). The remaining companies in the top 10, namely Antapaccay, Marcobre, Hudbay, and Sociedad Minera El Brocal, also showcased positive variations.

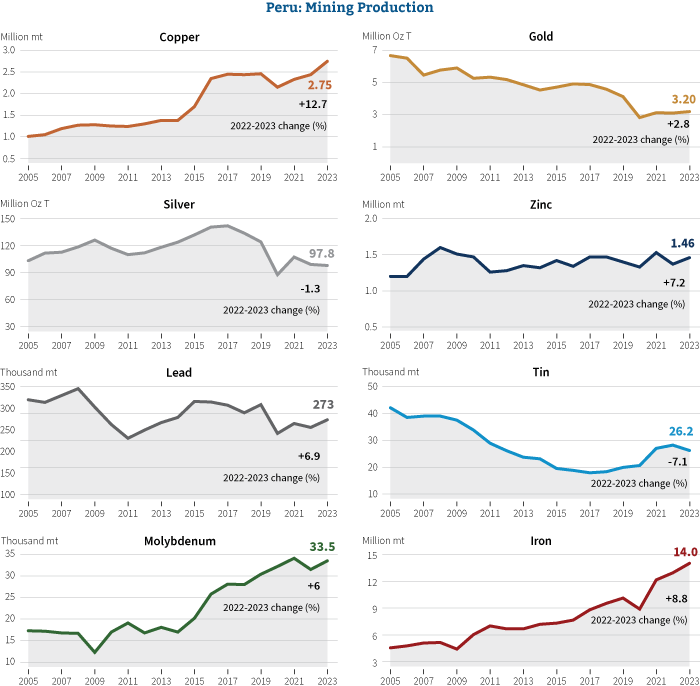

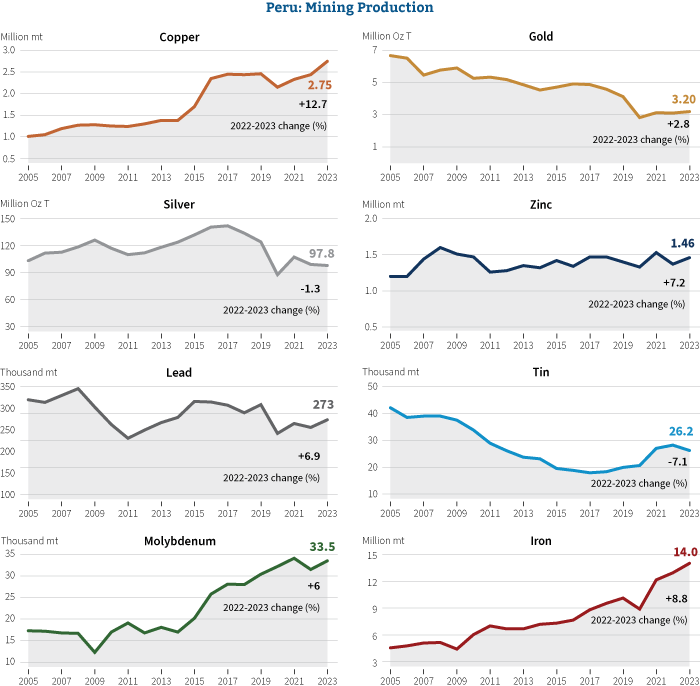

This collective performance has propelled Peru to achieve a steady production of 2.75 million metric tons, surpassing the Democratic Republic of Congo and securing its position as the world’s second largest copper producer.

2023 witnessed a surge in copper prices, particularly towards the year’s end. Globally, concerns arose about declining production due to lower grades and the suspension of activities at First Quantum Minerals’ Cobre Panama mine. Additionally, indications of monetary policies in the US contributed to a depreciation of the US dollar. As a result, 2023 concluded with the average copper price at US$3.89/lb. Despite favorable prices, which should encourage increased production and allocation of capital in exploration to replace depleting reserves, costs and inflation seem to be eating up profit margins.

To cope with the escalating demand for copper and preserve Peru’s position as the second-largest copper producer, operators of the red metal had to implement several measures and initiatives to enhance efficiency in copper processing, all while grappling with rising operational costs. Javier del Río, Hudbay’s vice president South America and USA, highlighted that the interplay between a looming supply deficit and challenges related to declining grades and depleting resources globally exerts pressure on prices. Rising costs further contribute to narrower profit margins despite the positive outlook for copper. “In this environment of heightened operational complexity and rising costs, it is imperative to streamline processes and enhance operational efficiency to safeguard profitability,” he said.

At a global level, Hudbay acquired Copper Mountain in British Columbia and Rockliff in Manitoba, both in Canada. Additionally, in the US it advanced the Copper World Complex in Arizona to a pre-feasibility stage. Locally, Hudbay has invested significant efforts in its Constancia mine (with the Pampacancha Satellite deposit) to navigate socio-political complexities while operating within expected guidelines.

Constancia has a processing capacity of around and approximately 90,000 t/d and a recovery rate of around 84%. The copper company invested in Magnetic Aggregation equipment for ultrafine particle filtration and a system to accelerate bubble discharge to enhance copper and molybdenum recovery. It also explored the implementation of ore sorting technology, which not only improves copper output but also helps to reduce energy consumption: “We have invested in new technologies, such as ore sorting, following the experience of Copper Mountain, and we want to implement it in Peru. At Constancia, we employ machine learning in throughput modeling, achieving over 90% effectiveness in predicting mill events. This allows optimized metallurgical responses by anticipating mineral behavior from crusher discharge to the processing plant,” concluded Del Río.

Adolfo Vera, president and CEO of Southern Peaks Mining (SPM) emphasized the need for “improving process efficiency and renegotiation terms with suppliers.”

In 2023, SPM encountered challenges in meeting the projected budget for Condestable’s production ramp-up, causing missed opportunities with the higher copper price. However, it recovered throughout 2023 to successfully meet the annual target: “As part of the renewal process of our EIA, we are including, among a few changes in some components, a production increase to 10,000 t/d. We are finalizing the technical details and drafting of the EIA for Condestable, which is set for submission during the first quarter of 2024,” explained Vera.

In line with enhanced mining efficiency, SPM transitioned to a global approach, consolidating mineralized blocks into a single reserve block: “While this integration may lead to a loss of ore grade in some areas, the gained efficiency outweighs the drawbacks. This has boosted our in-situ resources to over 120 million tons of copper, narrowing them down to 70 million tons of resources and 40 million tons of reserves. This represents a substantial 25% increase from our previous reserves of 32 million tons,” concluded Vera.

Precious Metals

In 2023, the precious metals segment witnessed record-breaking prices. Gold initially decreased after the Feds attempted to control inflation but gained appeal as a safe haven asset due to geopolitical events and increased central bank reserves. The closing average price for gold in 2023 was US$2,033.31/oz. Gold in Peru demonstrated a strong performance, with a 2.8% increase in gold production (3.1 million oz produced in 2022 vs 3.2 million oz in 2023).

The top performers in gold production for 2023 included Minera Yanacocha, leading the rank with a production of 275,681 ounces of gold, marking a significant 13.1% increase compared to 2022. Compañía Minera Poderosa followed closely, producing 269,518 ounces but experienced a slight decrease of 11.1% in its production. Consorcio Minero Horizonte exhibited notable growth, with a gold output of 203,108 ounces, representing an 8.3% increase. On the other hand, Minera Aurífera Retamas saw a modest decline of 5.5% in gold output, yielding 196,503 ounces. Meanwhile, Minera Boroo Misquichilca demonstrated a remarkable surge, achieving a 68.7% increase in production, totaling 175,649 ounces. Lastly, Hochschild’s Compañía Minera Ares faced a downturn, with a 13% decrease in production, reaching an output of 144,323 ounces.

In contrast, the silver segment experienced a slight dip of 1.3%, though less severe than the decline observed in 2022 (108 million oz in 2022 vs 107 million oz in 2022).

Despite facing challenges in early 2023 due to disruptions, Eduardo Landin, the new CEO of Hochschild Mining, commented that the company surpassed the reviewed production target, achieving a production of 300,749 oz of gold equivalent. A significant milestone for the company was securing approval for the Modified Environmental Impact Assessment (MEIA) for Inmaculada, enabling another 20 years of production with 262 hectares and 558 km of underground development.

Reflecting on gold prices and acknowledging the shrinking margins across the industry, Landin asserted that the company aims to be among the top cost quartiles to stay competitive, especially during price downturns. However, given the uncertain nature of gold price fluctuations, the company is preparing for both high and low-price scenarios: “To address this, the company implemented a ‘Zero Cost Collar,’ placing 100,000 oz of gold at a price range of between US$2,000 and US$2,252. If the price stays within this range, we receive the market price. If it falls below US$2,000, we receive this guaranteed figure and if it exceeds US$2,252, we receive the latter price. Although common in trading, this strategy is novel for the company and represents a proactive measure to manage exposure to the gold price, providing security in a fluctuating environment,” explained Landin.

Buenaventura ranked as the 10th largest gold producer in Peru, and experienced a 3.9% increase in production, aligning with the projected guidelines for 2023, according to Leandro García, Buenaventura’s CEO. Focused on the San Gabriel project, continuous efforts have resulted in noteworthy progress: “In San Gabriel, we concluded 2023 with engineering reaching 90%, procurement at 89%, and construction at 14%, contributing to an overall advancement of 28% by year-end. Additionally, we accomplished a CapEx of approximately US$140 million in 2023, with expectations to invest around US$200 million in 2024,” García commented.

Buenaventura aims to complete construction at San Gabriel in 2025 and secure the first gold bar by the end of that year.

Base Metals

Regarding base metals, Peru’s zinc production reached 1.47 million t/y in 2023, marking a substantial 7.2% increase compared to 2022 figures. Antamina continued to lead in zinc production, reaching an annual output of 527,979 metric tons, followed by Volcan at 171,117 metric tons and Nexa Resources at 84,710 metric tons. Antamina and Volcan both showed positive trends, with a 5.6% and 13.2% increase in production, respectively. However, Nexa Resources experienced a 6% decrease in its zinc production. Lead also demonstrated a robust 6.9% rebound in 2023, with Volcan, Nexa, and Compañía Minera El Porvenir emerging as the primary producers.

The zinc market dynamics were influenced by a combination of factors, including a sluggish post-COVID recovery in the Chinese economy leading to a drop in zinc prices, concluding 2023 on the LME at US$2,650/t.

“We are still living in the throes of 2023. The measures adopted by China led to a sustained drop in zinc prices mainly, while silver was more stable. A drop of nearly US$1,000/t of zinc since January 2023 is significant for the industry. As a producer of 250,000 t/y of fine zinc, it is one of the factors we are most sensitive to,” commented Luis Herrera, the recently appointed CEO of Volcan.

Volcan remains a key player, having achieved remarkable silver production of nearly 15 million oz/y and 250,000 fine t/y of zinc. With the ambitious Romina project in the pipeline for Peru, the company anticipates significant growth in both cash flow and metal production, reinforcing its position in the industry: “Romina has a forecasted mine life of 14 years with a production rate of 50,000 to 70,000 t/y of zinc equivalent,” commented Herrera.

Romina requires a US$150 million CapEx, but first the company must ensure it has the necessary resources to execute the project on time.

While Romina remains the company’s priority, Volcan has signed a JV with Antofagasta to explore prospective copper zones on the same trend as Toromocho: “The agreement has much potential, but there is a lot of work ahead of us and it entails significant investments in the coming years that could change Volcan’s exposure to the metals it produces. We have a large package of almost 350,000 hectares in mining concessions that are highly prospective,” added Herrera.

This joint venture represents the second strategic move by Chilean company Antofagasta in the Andean country. In December 2023, the gold producer Buenaventura revealed that Antofagasta had acquired an approximate 19% equity stake in the company.

Image courtesy of Anglo American

Peru’s top 10 copper producers have remained consistent, but notable rankings have changed. Cerro Verde has now taken the lead as the primary copper producer, experiencing a 1.6% increase in output (466,463 mt/y compared to the 459,100 mt/y produced in 2022). In contrast, Antamina, which held the top position in 2022, saw a 7% decrease, from almost 468,000 mt/y to 435,378 mt/y.

Southern Peru maintains its third-place position, showing a significant 9.4% increase to 374,189 mt/y from the 341,898 mt/y produced in 2022. Anglo American’s Quellaveco presented a 219.9% increase, becoming the fourth-largest copper producer in Peru, having produced 319,061 mt/y of copper. The mine was brought online in late 2022, so it must be noted that this uptick in production is logical, though crucial for Peru.

Las Bambas demonstrated a 18.5% increase, following a challenging first half of 2023, with operations picking up swiftly. The mine, operated by the Chinese MMG has produced 302,039 mt/y of copper in 2023 (vs 254,712 mt/y in 2022). On the contrary, Chinalco experienced an 18.1% decrease (200,317 mt/y in 2023 compared to 244,712 mt/y in 2022). The remaining companies in the top 10, namely Antapaccay, Marcobre, Hudbay, and Sociedad Minera El Brocal, also showcased positive variations.

This collective performance has propelled Peru to achieve a steady production of 2.75 million metric tons, surpassing the Democratic Republic of Congo and securing its position as the world’s second largest copper producer.

2023 witnessed a surge in copper prices, particularly towards the year’s end. Globally, concerns arose about declining production due to lower grades and the suspension of activities at First Quantum Minerals’ Cobre Panama mine. Additionally, indications of monetary policies in the US contributed to a depreciation of the US dollar. As a result, 2023 concluded with the average copper price at US$3.89/lb. Despite favorable prices, which should encourage increased production and allocation of capital in exploration to replace depleting reserves, costs and inflation seem to be eating up profit margins.

To cope with the escalating demand for copper and preserve Peru’s position as the second-largest copper producer, operators of the red metal had to implement several measures and initiatives to enhance efficiency in copper processing, all while grappling with rising operational costs. Javier del Río, Hudbay’s vice president South America and USA, highlighted that the interplay between a looming supply deficit and challenges related to declining grades and depleting resources globally exerts pressure on prices. Rising costs further contribute to narrower profit margins despite the positive outlook for copper. “In this environment of heightened operational complexity and rising costs, it is imperative to streamline processes and enhance operational efficiency to safeguard profitability,” he said.

At a global level, Hudbay acquired Copper Mountain in British Columbia and Rockliff in Manitoba, both in Canada. Additionally, in the US it advanced the Copper World Complex in Arizona to a pre-feasibility stage. Locally, Hudbay has invested significant efforts in its Constancia mine (with the Pampacancha Satellite deposit) to navigate socio-political complexities while operating within expected guidelines.

Constancia has a processing capacity of around and approximately 90,000 t/d and a recovery rate of around 84%. The copper company invested in Magnetic Aggregation equipment for ultrafine particle filtration and a system to accelerate bubble discharge to enhance copper and molybdenum recovery. It also explored the implementation of ore sorting technology, which not only improves copper output but also helps to reduce energy consumption: “We have invested in new technologies, such as ore sorting, following the experience of Copper Mountain, and we want to implement it in Peru. At Constancia, we employ machine learning in throughput modeling, achieving over 90% effectiveness in predicting mill events. This allows optimized metallurgical responses by anticipating mineral behavior from crusher discharge to the processing plant,” concluded Del Río.

Adolfo Vera, president and CEO of Southern Peaks Mining (SPM) emphasized the need for “improving process efficiency and renegotiation terms with suppliers.”

In 2023, SPM encountered challenges in meeting the projected budget for Condestable’s production ramp-up, causing missed opportunities with the higher copper price. However, it recovered throughout 2023 to successfully meet the annual target: “As part of the renewal process of our EIA, we are including, among a few changes in some components, a production increase to 10,000 t/d. We are finalizing the technical details and drafting of the EIA for Condestable, which is set for submission during the first quarter of 2024,” explained Vera.

In line with enhanced mining efficiency, SPM transitioned to a global approach, consolidating mineralized blocks into a single reserve block: “While this integration may lead to a loss of ore grade in some areas, the gained efficiency outweighs the drawbacks. This has boosted our in-situ resources to over 120 million tons of copper, narrowing them down to 70 million tons of resources and 40 million tons of reserves. This represents a substantial 25% increase from our previous reserves of 32 million tons,” concluded Vera.

Precious Metals

In 2023, the precious metals segment witnessed record-breaking prices. Gold initially decreased after the Feds attempted to control inflation but gained appeal as a safe haven asset due to geopolitical events and increased central bank reserves. The closing average price for gold in 2023 was US$2,033.31/oz. Gold in Peru demonstrated a strong performance, with a 2.8% increase in gold production (3.1 million oz produced in 2022 vs 3.2 million oz in 2023).

The top performers in gold production for 2023 included Minera Yanacocha, leading the rank with a production of 275,681 ounces of gold, marking a significant 13.1% increase compared to 2022. Compañía Minera Poderosa followed closely, producing 269,518 ounces but experienced a slight decrease of 11.1% in its production. Consorcio Minero Horizonte exhibited notable growth, with a gold output of 203,108 ounces, representing an 8.3% increase. On the other hand, Minera Aurífera Retamas saw a modest decline of 5.5% in gold output, yielding 196,503 ounces. Meanwhile, Minera Boroo Misquichilca demonstrated a remarkable surge, achieving a 68.7% increase in production, totaling 175,649 ounces. Lastly, Hochschild’s Compañía Minera Ares faced a downturn, with a 13% decrease in production, reaching an output of 144,323 ounces.

In contrast, the silver segment experienced a slight dip of 1.3%, though less severe than the decline observed in 2022 (108 million oz in 2022 vs 107 million oz in 2022).

Despite facing challenges in early 2023 due to disruptions, Eduardo Landin, the new CEO of Hochschild Mining, commented that the company surpassed the reviewed production target, achieving a production of 300,749 oz of gold equivalent. A significant milestone for the company was securing approval for the Modified Environmental Impact Assessment (MEIA) for Inmaculada, enabling another 20 years of production with 262 hectares and 558 km of underground development.

Reflecting on gold prices and acknowledging the shrinking margins across the industry, Landin asserted that the company aims to be among the top cost quartiles to stay competitive, especially during price downturns. However, given the uncertain nature of gold price fluctuations, the company is preparing for both high and low-price scenarios: “To address this, the company implemented a ‘Zero Cost Collar,’ placing 100,000 oz of gold at a price range of between US$2,000 and US$2,252. If the price stays within this range, we receive the market price. If it falls below US$2,000, we receive this guaranteed figure and if it exceeds US$2,252, we receive the latter price. Although common in trading, this strategy is novel for the company and represents a proactive measure to manage exposure to the gold price, providing security in a fluctuating environment,” explained Landin.

Buenaventura ranked as the 10th largest gold producer in Peru, and experienced a 3.9% increase in production, aligning with the projected guidelines for 2023, according to Leandro García, Buenaventura’s CEO. Focused on the San Gabriel project, continuous efforts have resulted in noteworthy progress: “In San Gabriel, we concluded 2023 with engineering reaching 90%, procurement at 89%, and construction at 14%, contributing to an overall advancement of 28% by year-end. Additionally, we accomplished a CapEx of approximately US$140 million in 2023, with expectations to invest around US$200 million in 2024,” García commented.

Buenaventura aims to complete construction at San Gabriel in 2025 and secure the first gold bar by the end of that year.

Base Metals

Regarding base metals, Peru’s zinc production reached 1.47 million t/y in 2023, marking a substantial 7.2% increase compared to 2022 figures. Antamina continued to lead in zinc production, reaching an annual output of 527,979 metric tons, followed by Volcan at 171,117 metric tons and Nexa Resources at 84,710 metric tons. Antamina and Volcan both showed positive trends, with a 5.6% and 13.2% increase in production, respectively. However, Nexa Resources experienced a 6% decrease in its zinc production. Lead also demonstrated a robust 6.9% rebound in 2023, with Volcan, Nexa, and Compañía Minera El Porvenir emerging as the primary producers.

The zinc market dynamics were influenced by a combination of factors, including a sluggish post-COVID recovery in the Chinese economy leading to a drop in zinc prices, concluding 2023 on the LME at US$2,650/t.

“We are still living in the throes of 2023. The measures adopted by China led to a sustained drop in zinc prices mainly, while silver was more stable. A drop of nearly US$1,000/t of zinc since January 2023 is significant for the industry. As a producer of 250,000 t/y of fine zinc, it is one of the factors we are most sensitive to,” commented Luis Herrera, the recently appointed CEO of Volcan.

Volcan remains a key player, having achieved remarkable silver production of nearly 15 million oz/y and 250,000 fine t/y of zinc. With the ambitious Romina project in the pipeline for Peru, the company anticipates significant growth in both cash flow and metal production, reinforcing its position in the industry: “Romina has a forecasted mine life of 14 years with a production rate of 50,000 to 70,000 t/y of zinc equivalent,” commented Herrera.

Romina requires a US$150 million CapEx, but first the company must ensure it has the necessary resources to execute the project on time.

While Romina remains the company’s priority, Volcan has signed a JV with Antofagasta to explore prospective copper zones on the same trend as Toromocho: “The agreement has much potential, but there is a lot of work ahead of us and it entails significant investments in the coming years that could change Volcan’s exposure to the metals it produces. We have a large package of almost 350,000 hectares in mining concessions that are highly prospective,” added Herrera.

This joint venture represents the second strategic move by Chilean company Antofagasta in the Andean country. In December 2023, the gold producer Buenaventura revealed that Antofagasta had acquired an approximate 19% equity stake in the company.