West Africa mining proves resilient to the pandemic and thrives off the gold revival.

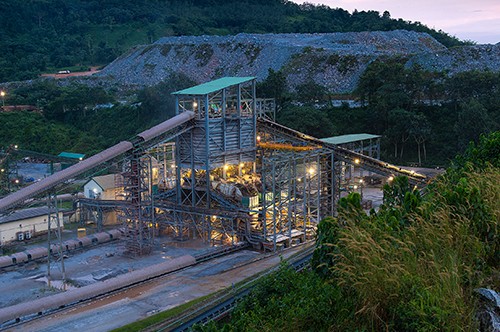

Image courtesy of Gold Fields

In West Africa, there are over 40 operating gold mines, many controlled by some of the world’s largest mining companies, including Newmont, Barrick, B2Gold, Endeavour, AngloGold Ashanti, Nordgold, as well as mid-tier producers like Kinross, IAMGOLD, Gold Fields, Resolute, Golden Star, and Teranga Gold. The region’s underexplored mineralization lends itself to mostly open-pit, near-surface, and thus cheap operations; most producers operate under an AISC of US$1,000/oz.

Years of controlling expenses are now paying off handsomely as those who looked after costs are reaping the benefits of high margins. This is also an opportune time to plan for the future.

Time to build the pipeline for the future

Toronto-based Teranga Gold, one of the top performers on the TSX with mines in Senegal and Burkina Faso, dealt with a dilemma back in 2015 when its Sabodala mine in Senegal was maturing. Teranga’s executive board pondered whether they should return money to shareholders or reinvest in the business, opting eventually for the latter. Teranga bought Gryphon Minerals in 2016, taking possession of two assets in Burkina Faso: the Wahgnion mine, which poured its first gold in 2019, and Golden Hill, an advanced exploration, grassroots discovery. “The board’s decision was based on a view that the sector had underinvested during the bull market and that, ultimately, grades and production will decline,” explained Richard Young, president and CEO of Teranga Gold.

As the cash from Q2 and Q3 this year begins to reflect on their balance sheets, producers face the same question that Teranga had five years ago: how to best take advantage of current market conditions? Strong gold fundamentals and solid cash flows allow producers the opportunity not only to pay off debts, but also to cut lower grades, expand their exploration budgets, and increase their pipelines, whether through organic or inorganic growth.

The matter of building a future pipeline is the most urgent. In the last six years, mining activity has continued, but exploration slowed down. As more gold was being extracted, fewer deposits were being discovered. In West Africa, the region’s landmark mines, including Morila and Obuasi, are reaching the bottom end of their existing resources, and even producing mines such as Gold Field’s Tarkwa or IAMGOLD’s Essakane mine have between 10 to 15 years of LOM.

Based on data from Mining Intelligence, Gold Fields has raised US$251,845,42 this year. For the first time in 15 years, Gold Fields managed to replace the depleting reserves at its low-grade, high volume Tarkwa flagship mine in Ghana, which produces over 500,000 oz/year: “I believe we did not offer Tarkwa its fair chance for exploration, and so we have now changed strategy and launched an aggressive and ample exploration program,” said Alfred Baku, executive VP and head of West Africa, Gold Fields.

The industry trend has been to focus on advanced-stage assets or exploration around the main mines, while budgets for greenfield exploration have halved over the past three decades. Recently though, the world’s largest producers have shown more predilection towards developing their exploration portfolios: “With its refocus on geology as a core discipline, Barrick’s exploration programs span the continent’s main gold belts, where it is hunting for new Tier One assets as well as for additional reserves to extend the lives of its existing mines,” Mark Bristow, president and CEO of Barrick Gold, told GBR.

Similarly, Teranga Gold has two contesting development projects that could turn into a third producing mine, the Golden Hill and the Afema, and has grown its annual production from 245,000 oz in 2018 to a projected 400,000 oz for this year. Exploration is also key at Endeavour Mining, which has one of the largest exploration portfolios in West Africa and discovered 8.4 million oz since 2016. After acquiring Exore Resources, ASX-listed Perseus came in the possession of 2,000 km2 of land around its Sissingue mill in Ivory Coast, and the company will now pursue organic growth.

One hyped-up transaction is the ongoing battle for the takeover of ASX-listed Cardinal Resources, which has seen subsequent price increases in counter-offers by the two bidders: Russian producer Nordgold and Chinese competitor Shandong Gold. In a less mediatized transaction, Future Global Resources is acquiring a 90% stake in Bogoso-Prestea gold mine, also in Ghana, for US$95 million. Other lower-scale consolidations are represented by Hummingbird Resources buying Cassidy Gold Guinea for US$12.67 million, for a deposit of 1.1 million oz, grading 2.1 g/mt.

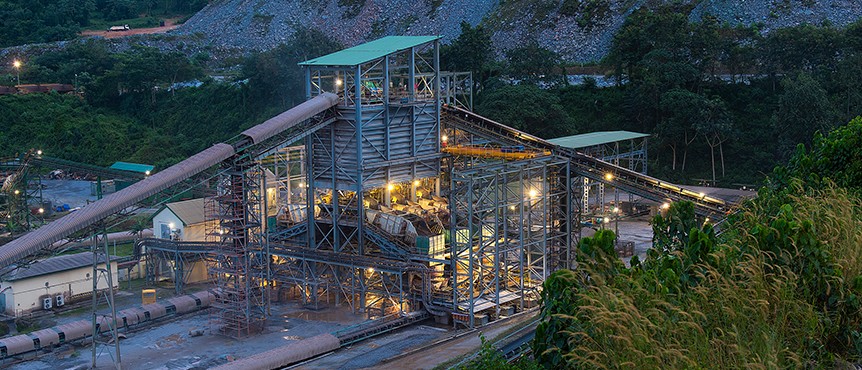

Image courtesy of Gold Fields

In West Africa, there are over 40 operating gold mines, many controlled by some of the world’s largest mining companies, including Newmont, Barrick, B2Gold, Endeavour, AngloGold Ashanti, Nordgold, as well as mid-tier producers like Kinross, IAMGOLD, Gold Fields, Resolute, Golden Star, and Teranga Gold. The region’s underexplored mineralization lends itself to mostly open-pit, near-surface, and thus cheap operations; most producers operate under an AISC of US$1,000/oz.

Years of controlling expenses are now paying off handsomely as those who looked after costs are reaping the benefits of high margins. This is also an opportune time to plan for the future.

Time to build the pipeline for the future

Toronto-based Teranga Gold, one of the top performers on the TSX with mines in Senegal and Burkina Faso, dealt with a dilemma back in 2015 when its Sabodala mine in Senegal was maturing. Teranga’s executive board pondered whether they should return money to shareholders or reinvest in the business, opting eventually for the latter. Teranga bought Gryphon Minerals in 2016, taking possession of two assets in Burkina Faso: the Wahgnion mine, which poured its first gold in 2019, and Golden Hill, an advanced exploration, grassroots discovery. “The board’s decision was based on a view that the sector had underinvested during the bull market and that, ultimately, grades and production will decline,” explained Richard Young, president and CEO of Teranga Gold.

As the cash from Q2 and Q3 this year begins to reflect on their balance sheets, producers face the same question that Teranga had five years ago: how to best take advantage of current market conditions? Strong gold fundamentals and solid cash flows allow producers the opportunity not only to pay off debts, but also to cut lower grades, expand their exploration budgets, and increase their pipelines, whether through organic or inorganic growth.

The matter of building a future pipeline is the most urgent. In the last six years, mining activity has continued, but exploration slowed down. As more gold was being extracted, fewer deposits were being discovered. In West Africa, the region’s landmark mines, including Morila and Obuasi, are reaching the bottom end of their existing resources, and even producing mines such as Gold Field’s Tarkwa or IAMGOLD’s Essakane mine have between 10 to 15 years of LOM.

Based on data from Mining Intelligence, Gold Fields has raised US$251,845,42 this year. For the first time in 15 years, Gold Fields managed to replace the depleting reserves at its low-grade, high volume Tarkwa flagship mine in Ghana, which produces over 500,000 oz/year: “I believe we did not offer Tarkwa its fair chance for exploration, and so we have now changed strategy and launched an aggressive and ample exploration program,” said Alfred Baku, executive VP and head of West Africa, Gold Fields.

The industry trend has been to focus on advanced-stage assets or exploration around the main mines, while budgets for greenfield exploration have halved over the past three decades. Recently though, the world’s largest producers have shown more predilection towards developing their exploration portfolios: “With its refocus on geology as a core discipline, Barrick’s exploration programs span the continent’s main gold belts, where it is hunting for new Tier One assets as well as for additional reserves to extend the lives of its existing mines,” Mark Bristow, president and CEO of Barrick Gold, told GBR.

Similarly, Teranga Gold has two contesting development projects that could turn into a third producing mine, the Golden Hill and the Afema, and has grown its annual production from 245,000 oz in 2018 to a projected 400,000 oz for this year. Exploration is also key at Endeavour Mining, which has one of the largest exploration portfolios in West Africa and discovered 8.4 million oz since 2016. After acquiring Exore Resources, ASX-listed Perseus came in the possession of 2,000 km2 of land around its Sissingue mill in Ivory Coast, and the company will now pursue organic growth.

One hyped-up transaction is the ongoing battle for the takeover of ASX-listed Cardinal Resources, which has seen subsequent price increases in counter-offers by the two bidders: Russian producer Nordgold and Chinese competitor Shandong Gold. In a less mediatized transaction, Future Global Resources is acquiring a 90% stake in Bogoso-Prestea gold mine, also in Ghana, for US$95 million. Other lower-scale consolidations are represented by Hummingbird Resources buying Cassidy Gold Guinea for US$12.67 million, for a deposit of 1.1 million oz, grading 2.1 g/mt.