"We repurpose refinery bottoms, preventing them from being incinerated, thus preventing tonnes of emissions. This process, although overlooked in the past, is now capturing greater attention due to global government initiatives aimed at reducing GHG emissions."

Share

Could you provide an update on the recent developments at Fortrec?

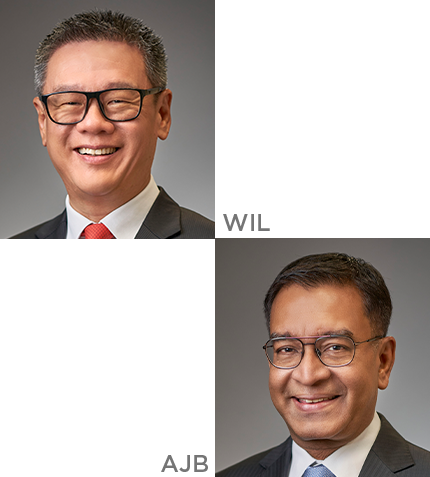

WIL: The first significant development is in the renewed management team. This renewal was in response to the changing marketplace dynamics and intended to strengthen the company as it navigates the changing landscape.

The second development concerns the reshaping of our trade financing structures. The post-COVID-19 era ushered in an unstructured supply chain environment that impacted the costs and financing of projects. Additionally, local company-related negative news in Singapore has plagued the trading sector. Although these events clearly do not concern Fortrec, we found it necessary to recalibrate our trade financing structures to respond to the growing change in perceptions held by the banks as a result of these events. To this end, our new CFO played a pivotal role in reshaping our financing structures. Consequently, we were able to rebuild our trade lines, which are now more efficient.

The third development is our expansion through such partnerships, and we will continue to strengthen our network, particularly in India, South Korea, and Saudi Arabia. Our existential partnership with a producer in India will mark a significant shift in our business model and will secure both the supply and demand for our products. This is yet another milestone that transits the company from a trading entity to an asset-based one.

Lastly, Fortrec recently completed a study in partnership with the National University of Singapore to determine the potential for carbon savings achieved through Fortrec’s core operations. The findings of this study confirm the significant savings in carbon emissions within our business model. It marks a vital step towards our commitment to environmental sustainability.

What are the main growth drivers for Fortrec’s product range in the Southeast Asian region?

AJB: Our products remain the key growth drivers of the business. They are predominantly used as feedstock for solvents and are extracted from refinery bottoms during the oil refining process. These solvents have various applications in major sectors, such as coatings and paints. To provide a demand perspective, the Indian coating market alone is worth US$12 billion.

Furthermore, our products are also applied in the agrochemicals sector.

How are Fortrec’s ESG initiatives contributing to the sustainability movement?

WIL: Fortrec has been contributing to the global sustainability agenda for decades. We repurpose refinery bottoms, preventing them from being incinerated, thus preventing tonnes of emissions. This process, although overlooked in the past, is now capturing greater attention due to the global government initiatives aimed at reducing GHG emissions.

Additionally, science has advanced to a level where we can mathematically prove that for every tonne of refinery bottoms we distil, we save approximately 3.3 tonnes of carbon emissions. This evidence is acknowledged by refineries today and has resulted in increased partnerships with them. We plan to make this process even more efficient by working on new methods. This includes the innovation of a newly improved product that removes a certain carcinogenic component from the present blending process. We intend to operationalize this innovation in collaboration with our partners in Saudi Arabia and India.

How do you see your company’s position in the industry compared to your competitors?

AJB: In terms of technology and strategy, we believe we are ahead of our competitors as we have an early-mover competitive advantage. Such partnerships have positioned us significantly ahead in the sustainability movement. Our strategy of locating our plants next to refineries yields two main benefits. Firstly, it cements our partnership with the refining companies, and secondly, it significantly reduces carbon emissions that may otherwise be generated from supply chain logistics.

Can you share your strategic plans for the coming years?

WIL: We aim to reach about US$300 million in revenue by 2026 through market expansion and network enhancement. We will do so by amplifying our presence in the agrochemicals and coatings markets, specifically in India and the Middle East. For network enhancement, we intend to establish new markets and invest strategically in specific plants to secure our supply and demand. We have identified specific strategic investments, particularly in Saudi Arabia and India, that we intend to intensify.

Could you provide an update on the recent developments at Fortrec?

WIL: The first significant development is in the renewed management team. This renewal was in response to the changing marketplace dynamics and intended to strengthen the company as it navigates the changing landscape.

The second development concerns the reshaping of our trade financing structures. The post-COVID-19 era ushered in an unstructured supply chain environment that impacted the costs and financing of projects. Additionally, local company-related negative news in Singapore has plagued the trading sector. Although these events clearly do not concern Fortrec, we found it necessary to recalibrate our trade financing structures to respond to the growing change in perceptions held by the banks as a result of these events. To this end, our new CFO played a pivotal role in reshaping our financing structures. Consequently, we were able to rebuild our trade lines, which are now more efficient.

The third development is our expansion through such partnerships, and we will continue to strengthen our network, particularly in India, South Korea, and Saudi Arabia. Our existential partnership with a producer in India will mark a significant shift in our business model and will secure both the supply and demand for our products. This is yet another milestone that transits the company from a trading entity to an asset-based one.

Lastly, Fortrec recently completed a study in partnership with the National University of Singapore to determine the potential for carbon savings achieved through Fortrec’s core operations. The findings of this study confirm the significant savings in carbon emissions within our business model. It marks a vital step towards our commitment to environmental sustainability.

What are the main growth drivers for Fortrec’s product range in the Southeast Asian region?

AJB: Our products remain the key growth drivers of the business. They are predominantly used as feedstock for solvents and are extracted from refinery bottoms during the oil refining process. These solvents have various applications in major sectors, such as coatings and paints. To provide a demand perspective, the Indian coating market alone is worth US$12 billion.

Furthermore, our products are also applied in the agrochemicals sector.

How are Fortrec’s ESG initiatives contributing to the sustainability movement?

WIL: Fortrec has been contributing to the global sustainability agenda for decades. We repurpose refinery bottoms, preventing them from being incinerated, thus preventing tonnes of emissions. This process, although overlooked in the past, is now capturing greater attention due to the global government initiatives aimed at reducing GHG emissions.

Additionally, science has advanced to a level where we can mathematically prove that for every tonne of refinery bottoms we distil, we save approximately 3.3 tonnes of carbon emissions. This evidence is acknowledged by refineries today and has resulted in increased partnerships with them. We plan to make this process even more efficient by working on new methods. This includes the innovation of a newly improved product that removes a certain carcinogenic component from the present blending process. We intend to operationalize this innovation in collaboration with our partners in Saudi Arabia and India.

How do you see your company’s position in the industry compared to your competitors?

AJB: In terms of technology and strategy, we believe we are ahead of our competitors as we have an early-mover competitive advantage. Such partnerships have positioned us significantly ahead in the sustainability movement. Our strategy of locating our plants next to refineries yields two main benefits. Firstly, it cements our partnership with the refining companies, and secondly, it significantly reduces carbon emissions that may otherwise be generated from supply chain logistics.

Can you share your strategic plans for the coming years?

WIL: We aim to reach about US$300 million in revenue by 2026 through market expansion and network enhancement. We will do so by amplifying our presence in the agrochemicals and coatings markets, specifically in India and the Middle East. For network enhancement, we intend to establish new markets and invest strategically in specific plants to secure our supply and demand. We have identified specific strategic investments, particularly in Saudi Arabia and India, that we intend to intensify.